Summary:

- Bank of America benefited from the solid economic situation in the United States.

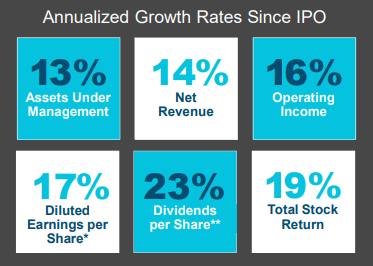

- The Consumer banking and Wealth Management Divisions are steady growth vectors.

- The bank has shown its ability to grow its revenue while controlling its expenses.

We started the most recent earnings seasons with several results coming from the financial sectors. Among them, investors had the chance to receive some substantial pay check raises. BlackRock (BLK) raised its payout by 8.7% and Wells Fargo (WFC) raised it by 12%. The most impressive increase came from Bank of America (BAC) with a 25% increase. Surfing on a strong US economy, BAC has posted a solid quarter. Is it time to buy some shares? Let’s take a deeper look!

Understanding the Business

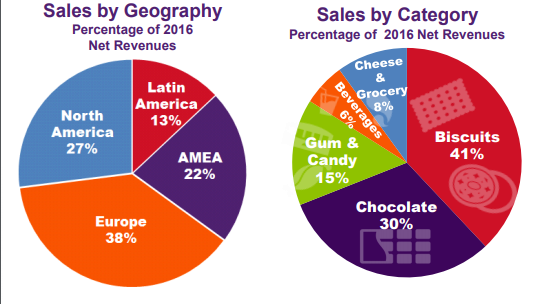

Bank of America Corporation is a bank holding and a financial holding company. The company provides financial products and services to people, companies and institutional investors. The company shows over $1 trillion in assets and has the most consumer deposit share in the U.S. BAC Consumer Banking division. It represents 38% of its net income, 32% for Global Banking, 15% for Global Markets and 15% for Global Wealth and Investment management.

Continue Reading »