Summary

- After its merger with SAB Miller, Anheuser-Busch InBev has proven to the world that it will “own the beer market” across the world.

- The company is dominant in many countries with 50%+ market share in Brazil, Latin America and Belgium.

- Unfortunately, the dividend perspectives don’t justify the current price.

Investment Thesis

Do you remember those BUD-WEIS-ER frogs in the company’s commercial a long time ago? I’m not sure I was old enough to drink beer back then but I surely enjoyed the frogs. In fact, Anheuser-Busch InBev (BUD) always had this magic touch to create viral ads. Over the years, the beer maker has expanded its brand portfolio to the limit of the world.

BUD is a leader in a stable market that is not ready to decrease. The company is producing over 500 million of hectolitres (as compared to 204 million for Heineken) and enjoys economy of scale. The brewer will continue to grow through acquisitions and will also increase its presence in emerging market, notably in China. BUD is a solid dividend payer with a 3.50% yield offering income seeking investors the opportunity to invest in a well-diversified company. Unfortunately, BUD seems overvalued at this time.

Understanding the Business

If you like beer, chances are you have drunk something coming from the world largest brewer. BUD dominates much of the market with 18 brands selling over $1 billion per year. Brand such as Budweiser (BUD shows 48% of US market share), Stella Artois (Belgium) and Corona are well known across the world. For the record, my own favorite beer is Hoegaarden.

With a production of over 500 hectolitres of beer per year, Budweiser sells more than twice the amount of beer Heineken sells. BUD is everywhere in the world:

Source: BUD 2017 Q3 investor presentation

Revenues

Source: Ycharts

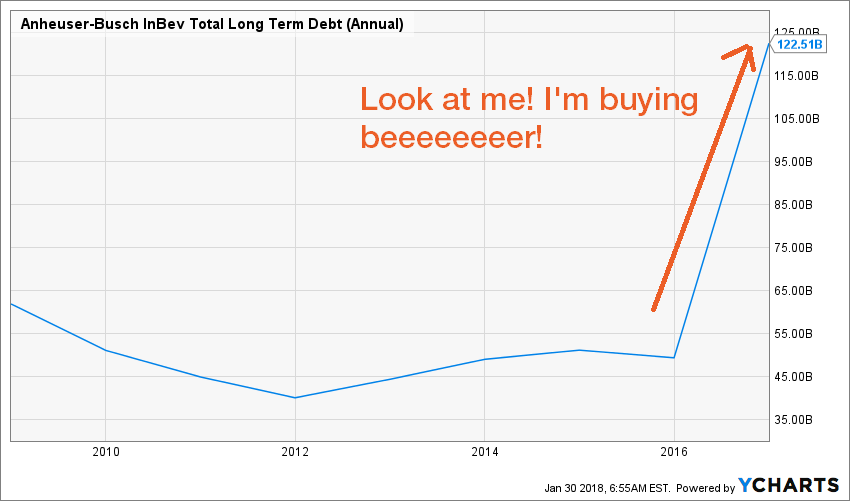

BUD shows a strong history of growth by acquisition. Their latest one propelled the whole business to new heights. With such a large operation, BUD obviously benefits from large economy of scale. It is also the first brewer to be able to acquire another brewer (such as SAB Miller in 2016 in a +$100 billion deal). Through acquisition, BUD increases its leadership position, boosts new brands through its well-developed network and enjoys additional synergies. Through its 62% stake in Ambev, BUD is a leader in many Latin American countries such as Brazil (64% market share) and Argentina (77% market share).

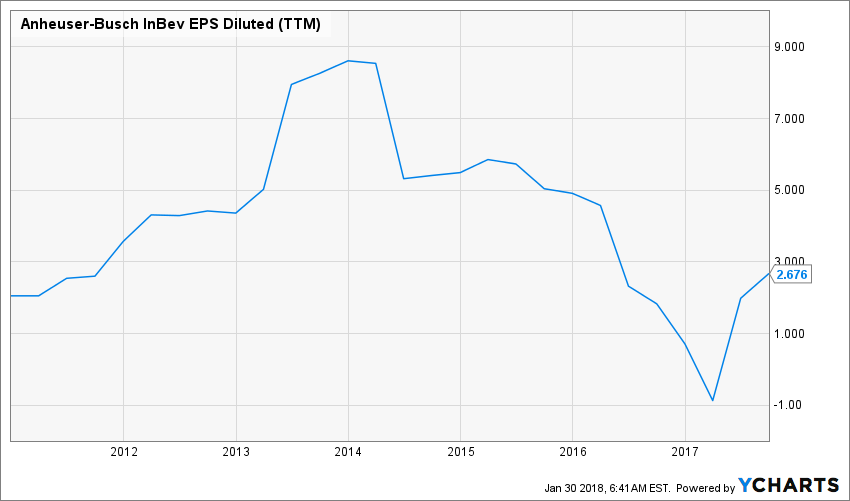

Earnings

Source: Ycharts

The key for BUD in the upcoming year will be to develop premium beers such as Michelob Ultra and Stella Artois and focus on craft & imports. Unfortunately, there is a very limited growth potential for brands such as Budweiser & Bud light as they literally own the market in the U.S. Therefore, profitability will be found across premium pricing on “sophisticated beers”. This is not only a way to ensure profit growth, but also to protect BUD’s market share. There is a definite growing interest for craft and import beers as consumers enhance their taste for beer.

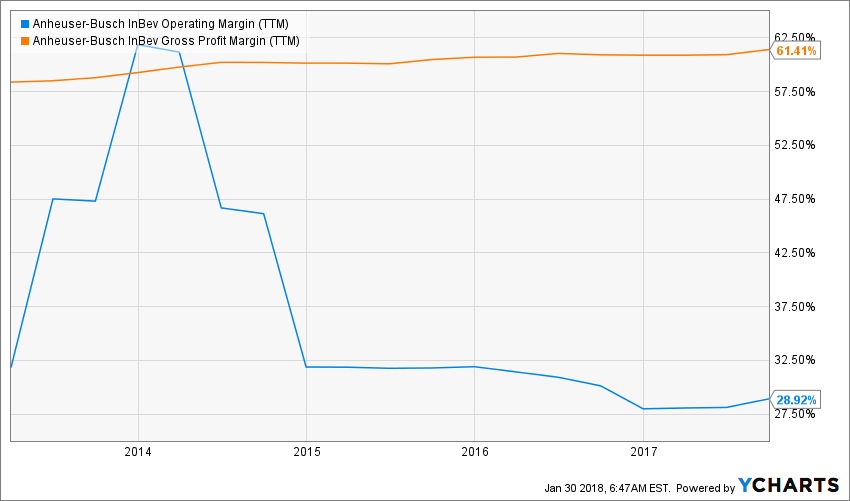

Another growth vector for the upcoming years will definitely be Latin America. While BUD is already the leader in those countries, the recent economic rebound should invite more consumers to celebrate and have a “cold one”. Both revenue and profit were up in those countries during Q3 by +8.9% and +13.1% (West), +8% and +16+.7% (North), +22.1% and +17.3% (South) respectively. BUD will need to work on its margin expansion in the upcoming years as the SAB Miller merger has already generated over $1 billion in synergy.

Source: Ycharts

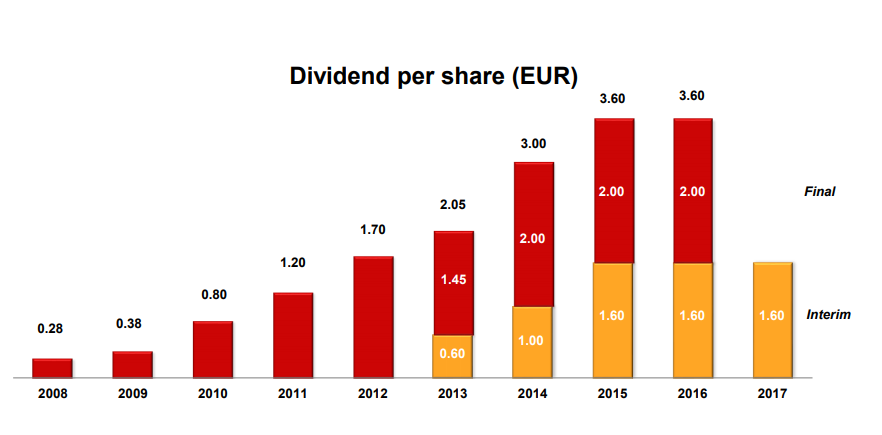

Dividend Growth Perspectives

The fact that the BUD dividend is paid in euroes generates additional variations. According to Divdiend.com, BUD shows 8 consecutive years with a dividend increase. Considering the latest acquisitions and the current debt level, I don’t think we will see much dividend increase in the upcoming years. BUD shows a strong business model, but its tastes for acquisitions doesn’t give it the perfect dividend growth profile.

Source: BUD 2017 Q3 investor presentation

Source: Ychart

That is unfortunate as BUD was very close to becoming a Dividend Achiever. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

At this point, I still consider BUD as a dividend paying stock, but I don’t put too much fate into future dividend growth perspectives.

Potential Downsides

First, it is hard to grow when you are that big. One problem with BUD is that many of its brands have nowhere to go in terms of market share. It is hard to imagine Budweiser increasing its market share. In fact, it’s having a hard time against other imported beer and smaller or local microbreweries. While the company generated synergies with SAB Miller, it is still a big pill to swallow. Its long term debt totals over $120 billion at the moment. Finally, as the company makes about 50% of its revenue offshore and has a strong presence in Latin America, BUD is subject to additional volatility (from both currency and unstable Latin America markets).

Valuation

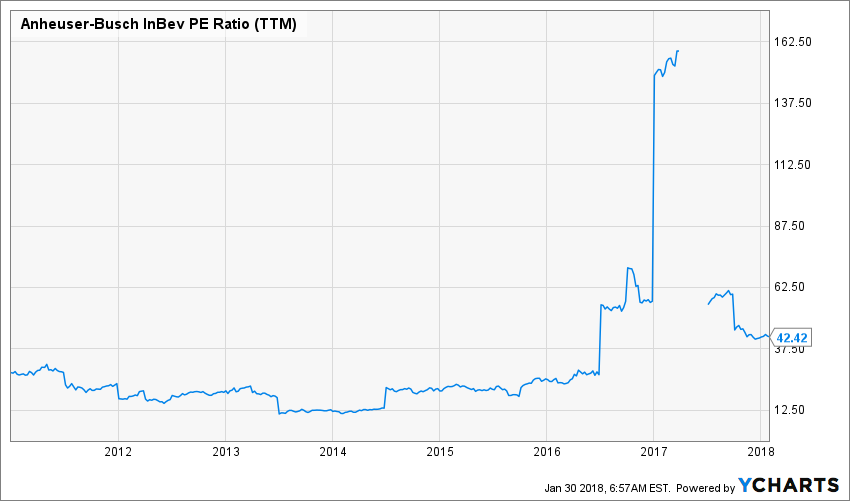

It is hard to determine the real valuation of BUD at the moment. With the important acquisitions, all numbers are a little bit skewed, starting with the EPS. At the moment, BUD has never been that highly valued in the past decade:

Source: Ycharts

I also tried to use the Dividend Discount Model to determine a fair value for BUD. The problem is that I’m not sure there will be much dividend growth in the upcoming years. I’ve used a 5% growth rate as I felt generous. The immediate dividend growth may not happen, but management showed the ability of doing major dividend hikes in the past. This could very be the case in a few years from now.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $4.07 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $170.94 | $128.21 | $102.56 | |

| 10% Premium | $156.70 | $117.52 | $94.02 | |

| Intrinsic Value | $142.45 | $106.84 | $85.47 | |

| 10% Discount | $128.21 | $96.15 | $76.92 | |

| 20% Discount | $113.96 | $85.47 | $68.38 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Unfortunately, even with generous numbers, BUD is still overvalued. Keeping this in mind, I don’t think it’s a good candidate for my dividend growth portfolio.

Final Thought

When I started this analysis, I was relatively optimistic about BUD. It’s global presence and leadership in many markets made me like the company… a lot. BUD benefits from strong economy of scale and a wide distribution network. That makes it easier for it to acquire other brewers and push new products through its lines of business. Unfortunately, BUD just swallowed a big piece and will need some time to recover. I don’t think we can call it a hangover just yet, but when you have a few beers, this is certainly not the right time to start sprinting. I will leave BUD on the side for now.

Disclaimer: I do not hold BUD in my DividendStocksRock portfolios.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]