Summary

- PC sales are sluggish? Microsoft just moved towards the cloud at fast pace.

- MSFT strong relationships with Corporate America will help the company integrate many other services.

- The tech giant successfully switch from a one time software sale to a subscription based product with Office 365.

Microsoft (MSFT) has polarized investors for a while now. On one side, bears are telling the world that PC sales are going nowhere. Bears even come up with this theory that the PC era is dead and it will bring MSFT in its hole. I can’t argue with PC sluggish sales, bears are right on this point:

Source: Statista

Nonetheless, I disagree with their investment thesis. Microsoft is a resourceful company and saw PC sales headwinds coming at them a while ago. Over the past few years, it has moved its one time software sales approached towards subscriptions based with the creation of Office 365 (sales were up +41% during the latest quarter). It built a strong cloud environment climbing to #2 in the public business and integrating multiple solutions for businesses. I think Microsoft shares will easily hit the $100 mark, here’s why.

Understanding the Business

First, repeat after me: Microsoft isn’t just Windows and Office anymore. While the company has been tied to PC sales decades, this business model is dead already. Microsoft is the worldwide leader in software, services, devices and solutions helping consumers and businesses to become more productive. The company operates under 3 segments.

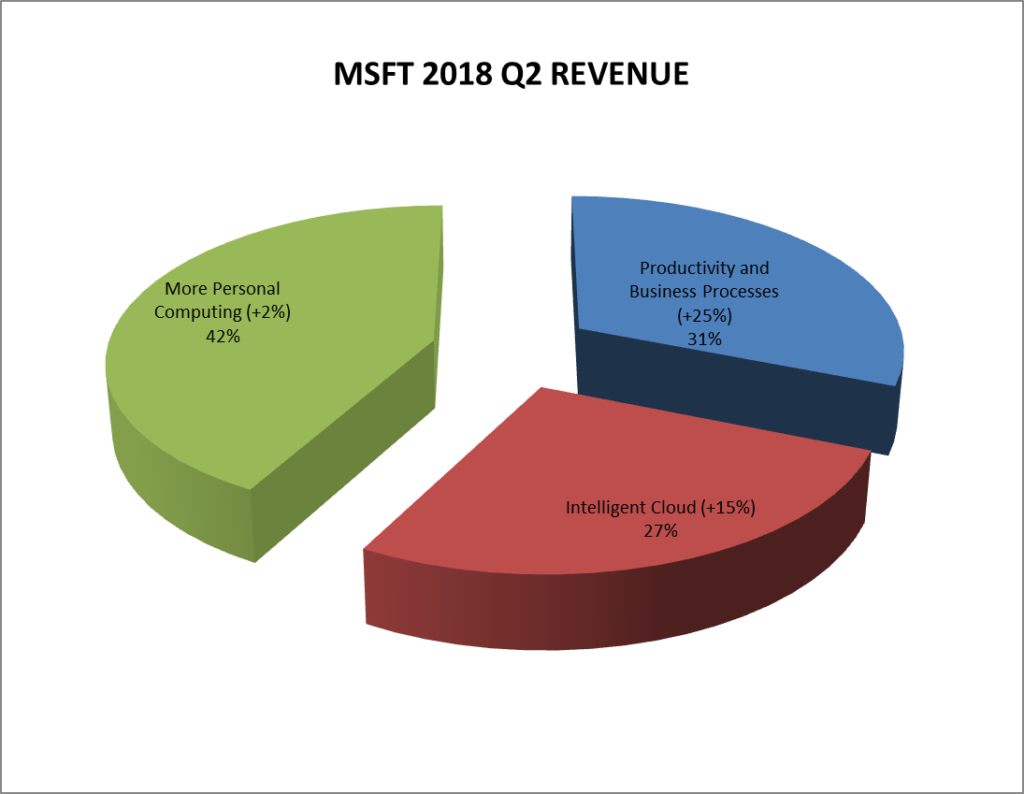

Source: author’s table based on Q2 2018 results

More Personal Computing (+2% Q2 2018) is still MSFT’s largest business segment with 42% of its revenue. This is probably why investors still think this tech giant is all about PC sales. This segment shows modest growth, but gaming revenue is showing a steady uptrend (+8%) with its Xbox live platform.

Productivity and Business Processes (+25% Q2 2018) is Microsoft’s second largest division. It includes its Office 365 service that is now based on a subscription model. LinkedIn results are also included within this segment.

Intelligent Cloud (+15% Q2 2018) may be the smaller units in MSFT, but it shows a strong potential. Public and corporate cloud services are growing at a fast pace. Azure shows 10 consecutive quarters with 90%+ growth.

Growth Vector

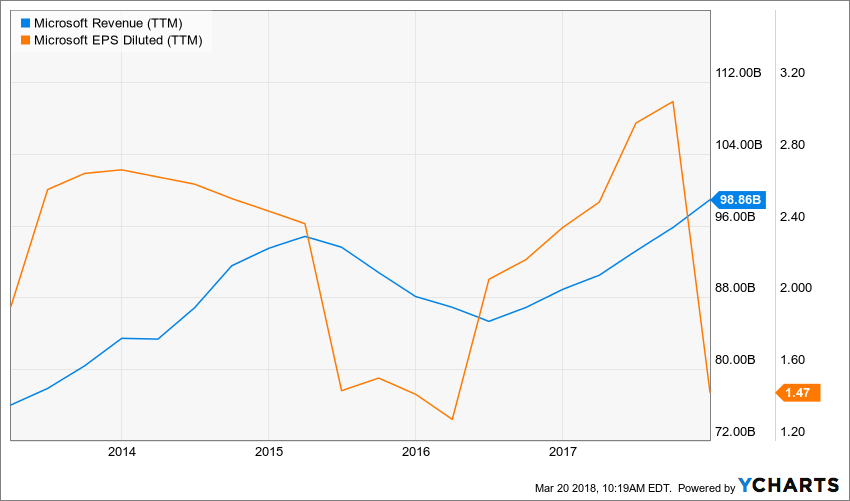

Source: Ycharts

Microsoft counts several growth vectors to ensure its future growth. First, the cloud business growth will last for a decade. MSFT currently shows over 800 case studies of cloud services provided to corporate clients on its website. Its strong bond with its clients is the reason why Microsoft came as a natural choice for businesses and governments when it’s time to move toward cloud based solutions for their operations. In the public space, Amazon (AMZN) remains the leader in this business and proved this business as highly profitable. Microsoft is a solid #2 with Azure showing nearly 3 years of impressive growth.

Second, MSFT is pushing its relationship with Corporate America to a whole new level. MSFT has never been afraid to deploy money to find additional growth vectors. It acquired several companies like Skype and LinkedIn. MSFT also developed its own applications including Teams (MSFT response to Slack, a cloud based workspace for businesses). Now, MSFT shows the most complete offer to businesses who want to improve their productivity. This “all-in-one” offer positions MSFT as a natural choice if you want to reach the next step with your business.

Third, subscription based solutions will drive increasing cash flow in the upcoming years. There was once a time where Windows & Office versions were the only way MSFT could push its revenue up. It was constantly working on a software cycle trying to convince clients to upgrade their system on a constant basis. Now that MSFT has shifted toward Office 365, clients will just keep paying their subscription and benefit from future upgrades. This makes cash flow more predictable and should boost margins along the way.

Dividend Growth Perspective

Microsoft shows 14 years of consecutive dividend increases. This makes it part of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

I’ll agree with you, MSFT yield has lost its appeal now that it is lower than the 2% mark. But take a second to look at the blue line on the graph to see how fast MSFT price grew since 2016. Even if its dividend jumped by 82.61% over the past 5 years, it wasn’t enough to keep the yield at its 2.50%-3% levels. This means one thing; Microsoft is back on strong growth mode.

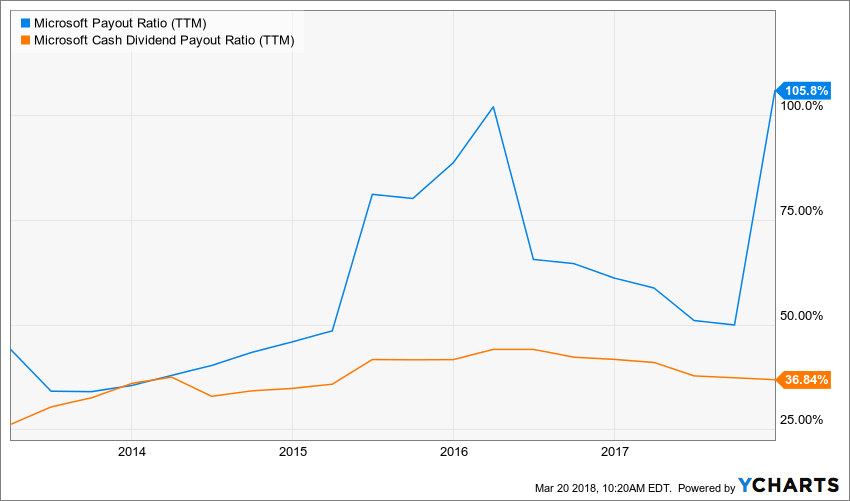

Source: Ycharts

MSFT payout ratio seems through the roof after its latest quarter but that was just related to a $13.8 billion net charge related to the Tax Cuts and Jobs Act. If you look at the cash payout ratio, you will notice that it is not only low (37%), but that it has been decreasing for the past 12 months. The effect of subscription based solutions is starting to show.

MSFT shareholders can expect a high single-digit dividend growth rate for several years to come. I wouldn’t be surprised to see MSFT showing a 9% dividend CAGR for the next decade.

Potential Downsides

The fact that PC sales are going down in the upcoming decade will not help MSFT. But instead of dragging MSFT results in negative territories, I think it will have a modest impact as the company grows in other sectors.

While MSFT is currently spending its money well, management made several bad acquisitions throughout its history. I guess that having so much money in hands could be dangerous sometimes. Let’s hope MSFT will continue to use its money wisely instead of buying another Nokia…

Valuation

When I bought shares of MSFT at $75 before its Q1 2018, many were saying that it was overpriced. Since then, the stock surged to $90+. Maybe it is overpriced now?

Source: Ycharts

MSFT 12 months forward PE ratio is at 25.61. While this number alone seems relatively high, I think it’s the right price to pay for such a leader with many growth avenues.

Going deeper, I used the dividend discount model to see how much MSFT should be trading at. I was pleasantly surprised to find significant value in MSFT.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.68 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 9.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 7.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $257.75 | $128.02 | $84.81 | |

| 10% Premium | $236.27 | $117.35 | $77.74 | |

| Intrinsic Value | $214.80 | $106.68 | $70.67 | |

| 10% Discount | $193.32 | $96.01 | $63.61 | |

| 20% Discount | $171.84 | $85.34 | $56.54 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

With a stock trading around $90, there is roughly a 15% immediate upside. You may think that a 9% and 7% dividend CAGR is generous, but keep in mind that Microsoft has increased its payout by 282% over the past 10 years for a CAGR of 14.34% and still shows a cash payout ratio under 40%. Therefore, expecting a high single-digit dividend growth rate is justifiable. MSFT will hit $100 in no time.

Final Thought

Don’t let bears tell you what to do. While the market is currently volatile, there is one thing I’m sure; Microsoft will be thriving in the next 10 years and I certainly don’t want to miss the growth. MSFT shows a great combination of steady cash flow generation and growth vectors insuring years of joy for shareholders.

Disclaimer: I do hold MSFT in my DividendStocksRock portfolios.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]