Summary

- One of the top three self-storage REITs with good properties and an expanding portfolio

- Growing strongly through both organic and inorganic routes

- Macroeconomic factors like a growing population and rising rents acting as tailwinds

This article has been written by Sneha Shah for The Dividend Guy.

Investment Thesis

One of the main reasons to invest in REITs is their attractive returns (at least 90% of its income is required to be distributed). REITs, which focus on self-storage properties, are even better as they are less sensitive to economic downturns than other real estate product types.

CubeSmart is amongst the top three national owners and operators of self-storage facilities in the United States. Its portfolio of high quality properties in good locations and a diversified customer base have enabled long term value creation for its shareholders. CubeSmart has been regularly increasing its payout over the last seven years and is just three years away from making it to the Dividend Achievers list. It offers a yield of over 4% and its strong cash flows imply investors have nothing to fear about future payouts as well.

Understanding the Business

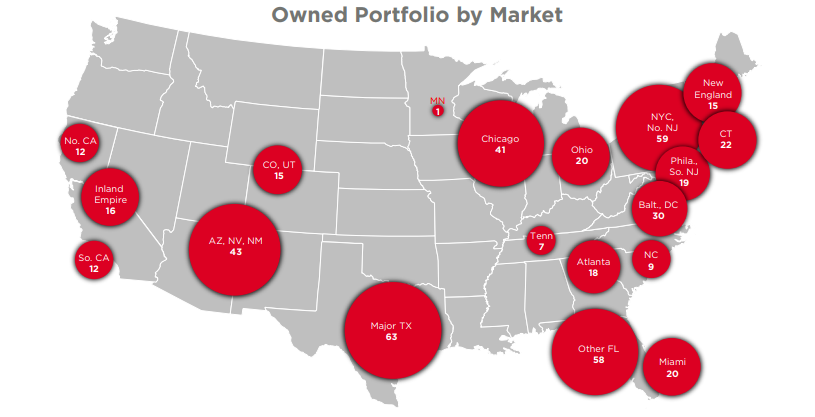

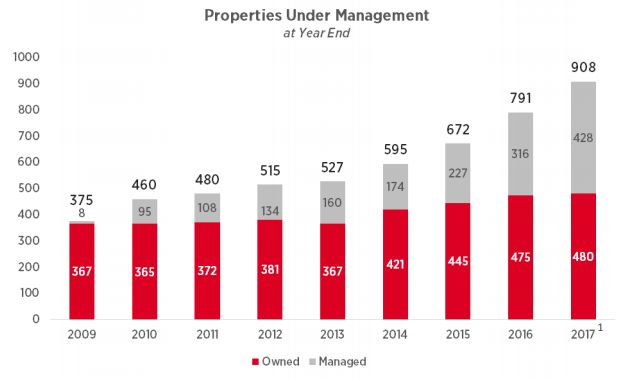

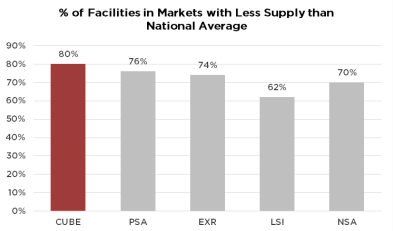

Founded in 2004, CubeSmart (CUBE) is a real estate investment trust (REIT) that engages in the ownership, operation, acquisition and development of self storage facilities in the US. It operates a portfolio of 908 stores, more than half of which is owned by CubeSmart, in 23 states and District of Columbia. Its high quality portfolio focuses on supply constrained markets with good demographics.

The REIT earns its revenues principally from rent received from customers under month-to-month leases, which provides good short-term visibility and the ability to upwardly adjust rents in case of inflation.

Source : CubeSmart Investor Presentation

Revenues

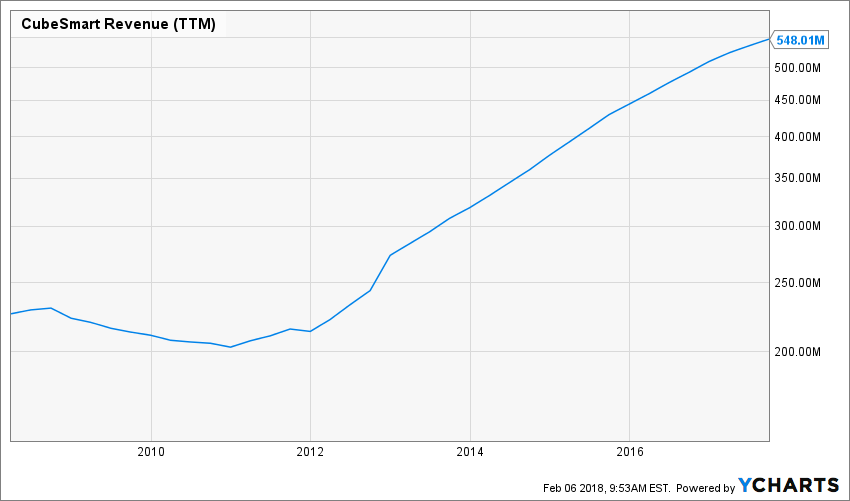

Source: Ycharts

The REIT caters to the needs of a wide range of residential and commercial customers. Its properties have an average occupancy rate of 93.3% and are located near densely populated retail centers. Stores in metropolitan cities like Florida, New York, Texas, and California accounted for 17%, 16%, 10% and 8%, respectively, of CubeSmart’s total 2016 revenues.

The self-storage industry in the US is highly fragmented and consists of around 51,000 facilities having 2.6 billion rentable square feet space. About 16% of the total rentable square footage is owned by the top 10 operators collectively, which indicates that CubeSmart has a huge market to grow.

In addition to growing organically, CubeSmart is also focusing on acquisitions and has invested and estimated $50 million in making strategic acquisitions and adding 123 new properties (till November 2017).

Source: CubeSmart Investor Presentation

Earnings

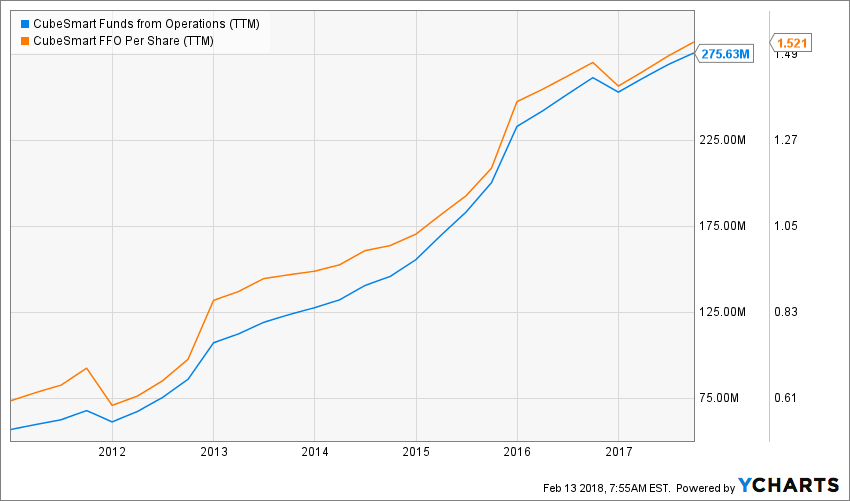

Source: Ycharts

Cube Smart has successfully grown both its revenues and earnings over the last few years. Its funds from operation (FFO) have grown continuously every quarter in 2017, with the last quarter reporting an increase of 10.5% y/y.

The company is looking at maximizing its cash flows by increasing rents, occupancy levels and number of facilities; and by controlling operating expenses. In addition, CubeSmart’s Third Party Management program has allowed to leverage its operating platform, and develop an additional revenue stream.

As a publicly traded REIT with a BBB/Baa2 investment grade balance sheet, CubeSmart also has easy and multiple sources of access to capital.

Management estimates full year 2017 FFO per share, to range in between $1.57 and $1.58, which represents an increase of 9.4% y/y.

Source: CubeSmart Investor Presentation

Dividend Growth Perspective

Source: Ycharts

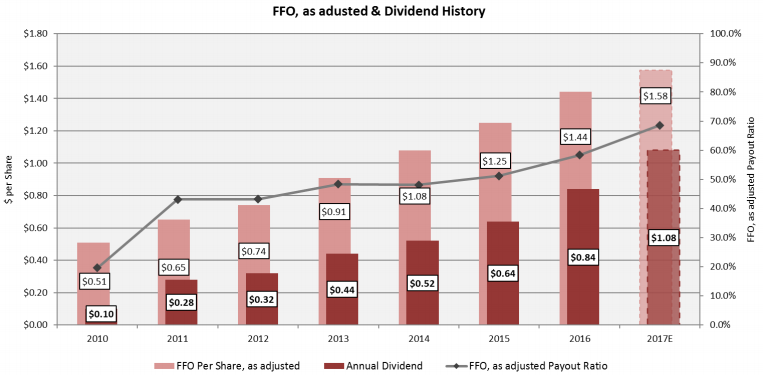

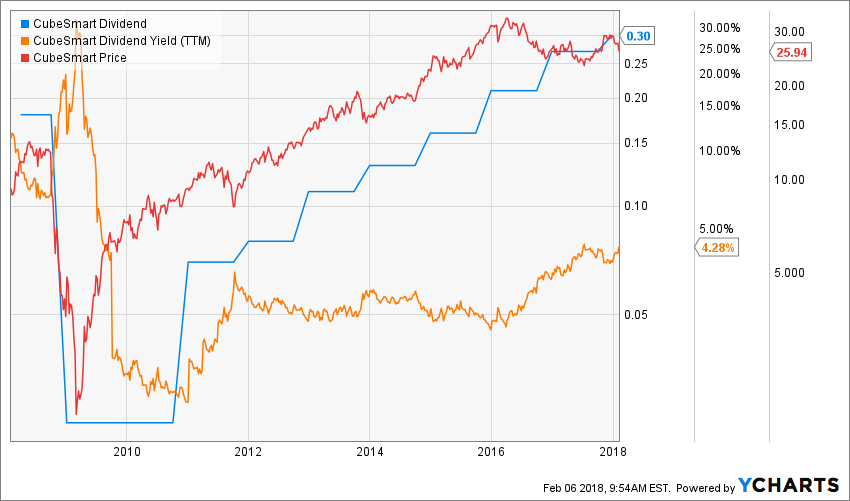

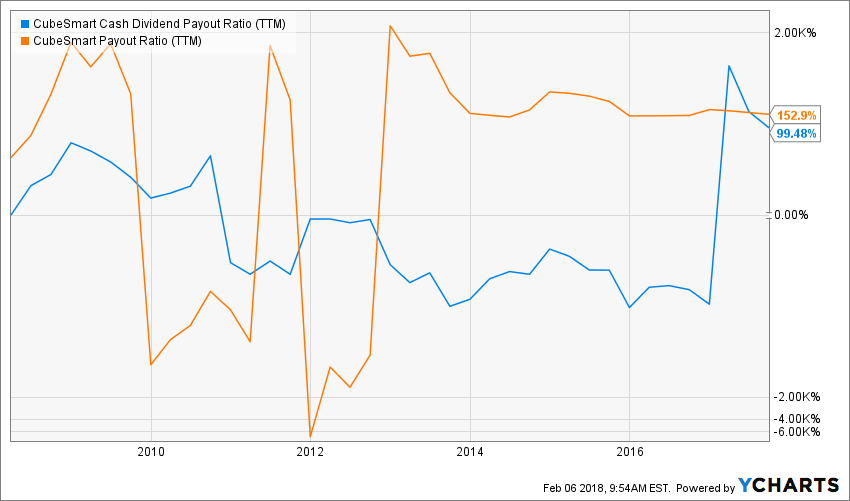

CubeSmart has an impressive dividend growth track record, increasing payouts by 28% CAGR over the last five years and by 23% in the last year itself. It has also grown its payout for the last seven years in a row and has a current yield of 4.2%. Its payout ratio stands close to 71% which is reasonable for REITs.

Strong cash flow generation and a disciplined investment strategy has allowed for meaningful increases in distributions to shareholders.

Source: Ycharts

Self-storage businesses are expected to perform better in good economies where people end up buying more things but have little space to store.

Potential Downsides

Rising interest rate is the biggest risk for CubeSmart, which reduces the attractiveness of investing in REITs. With US Treasury yields increasing sharply in 2018, CUBE might come under pressure.

An increasing population choosing to start families late and an older generation downsizing their homes could pose potential challenges for CubeSmart. Oversupply concerns and heightened competition are also potential risks.

Natural calamities can also adversely impact operation. CubeSmart estimates $1.4 million in repair costs, net of insurance proceeds, for damages caused by hurricanes Harvey and Irma.

Valuation

CubeSmart is a one of the biggest players in the self-storage market and should continue to grow through industry consolidation. Its market capitalization value is just $4.7 billion compared to $32 billion for Public Storage (PSA), industry’s largest player.

CUBE is currently trading at higher valuation relative to the industry median. It maintains a net debt-to-EBITDA ratio of 4.8x which is lower than industry average of ~6x.

Source: Ycharts

I have also used the Dividend Discount Model to determine a fair value for CUBE. Given CubeSmart’s strong cash flow growth, a conservative balance sheet and past growth I have assumed a dividend growth rate of 6% in the initial period and reduced it to 5% going forward. As for the discount rate, I never use under 9%. The output shows that the stock is currently reasonably valued.

Input Descriptions for 15-Cell Matrix INPUTS

Enter Recent Annual Dividend Payment: $1.11

Enter Expected Dividend Growth Rate Years 1-10: 6.00%

Enter Expected Terminal Dividend Growth Rate: 5.00%

Enter Discount Rate: 9.00%

Discount Rate (Horizontal)

Margin of Safety 8.00% 9.00% 10.00%

20% Premium $50.71 $37.91 $30.24

10% Premium $46.48 $34.75 $27.72

Intrinsic Value $42.26 $31.59 $25.20

10% Discount $38.03 $28.43 $22.68

20% Discount $33.81 $25.27 $20.16

Please read the Dividend Discount Model limitations to fully understand my calculations.

Final Thought

The self-storage business is a slow changing, relatively stable and predictable business because consumers need a place to store their stuff even during recessions. CubeSmart being an industry leading name with a strong operating performance and a conservative balance sheet should continue to grow steadily in the coming years. It is in a good position to acquire high-quality assets in select markets and leverage the expertise of its partners to generate attractive returns.

Disclosure: I do not hold CUBE in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]