Summary

It’s key advantage is CMI’s expertise in the design of lower emission generating engines.

CMI is working with its clients to meet new regulation requirements from the Environmental Protection Agency.

CMI’s ability to protect its know-how in designing more eco-friendly engines will open doors to markets such as India and China.

CMI is working with its clients to meet new regulation requirements from the Environmental Protection Agency.

CMI’s ability to protect its know-how in designing more eco-friendly engines will open doors to markets such as India and China.

DSR Quick Stats

Sector: industrials

5 Year Revenue Growth: 7.64%

5 Year EPS Growth: 18.13%

5 Year Dividend Growth: 32.03%

Current Dividend Yield: 3.43%

5 Year Revenue Growth: 7.64%

5 Year EPS Growth: 18.13%

5 Year Dividend Growth: 32.03%

Current Dividend Yield: 3.43%

What Makes Cummins (CMI) a Good Business?

Cummins Inc., a global power leader, is a corporation of complementary business units that design, manufacture, distribute and service diesel and natural gas engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions and electrical power generation systems.

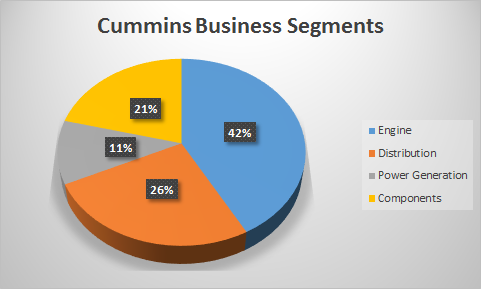

The company is divided into 4 business segments:

Source: author’s table, data from Cummins financial reports

Source: author’s table, data from Cummins financial reports

Source: author’s table, data from Cummins financial reports

Source: author’s table, data from Cummins financial reports

Cummins’ business model is closely related to the transportation, mining and infrastructure industries as 42% of its sales come from its engine division. The demand for heavy-duty and medium-duty trucks/bus engines are the two biggest sectors of this division with $631M in sales (-17%) and $549M (-10%) respectively during their latest quarter.

The company has a long time expertise in building efficient engines with low emissions. As environmental regulations increase each year, we can see a strong economic moat for Cummings.

Ratios

Price to Earnings: 15.06

Price to Free Cash Flow: 14.09

Price to Book: 2.2798

Return on Equity: 17.71%

Price to Free Cash Flow: 14.09

Price to Book: 2.2798

Return on Equity: 17.71%

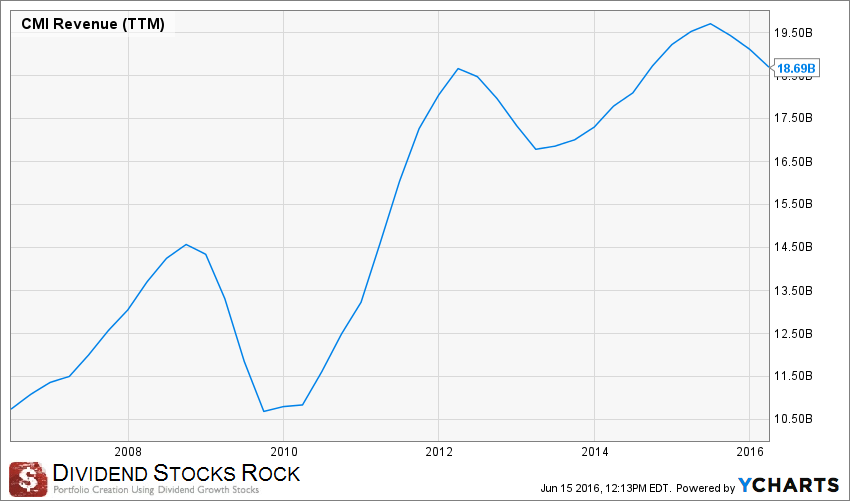

Revenue

The demand for engines in North America and Brazil has been lower than in previous years and this is mainly why Cummins shows a decrease in its revenue in 2016. Management expects revenue to drop by 5 to 9% yoy for 2016.

How CMI fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Source: Ycharts

Source: Ycharts

Source: YchartsPrinciple #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

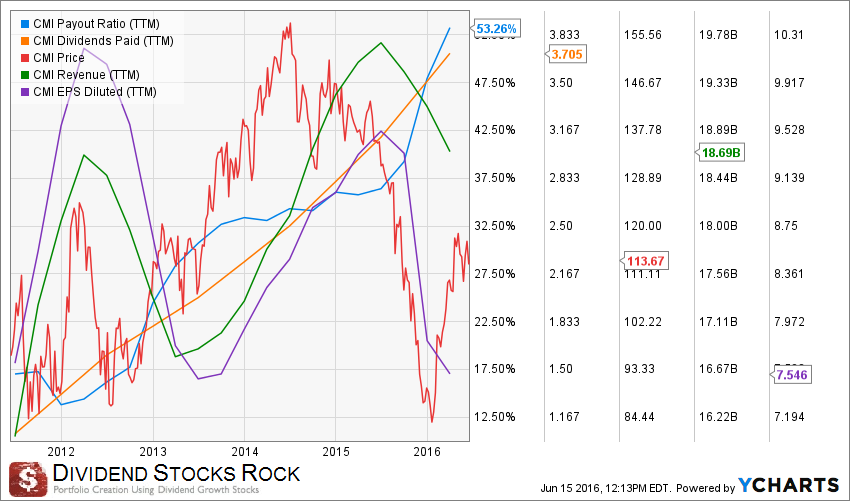

As you can see, CMI dividend yield has been low historically. Besides the 2008 crisis, the company used to pay a yield between 1% and 2% for most of the decade. The stock yield has recently increased due to a very steep dividend growth increase rate and a recent drop in the stock price.

Most industrials have the bad habit of following cyclical trends. The good news is when you didn’t buy it yet, it opens great opportunities for new investors. Entering a position in CMI at 3.43% dividend yield seems like a good deal so far.

CMI meets my 1st investing principle.

CMI meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

CMI has been more than generous with its shareholders over the past 5 years. In fact, the company shows a dividend growth rate of 32.03% CAGR. It has successfully increased its dividend for the past 6 years in a row after taking a small pause of 1 year in 2009 following the latest recession. With their recent strong dividend increase, management has made a solid statement that dividend growth was a priority for them too. CMI meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company.As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

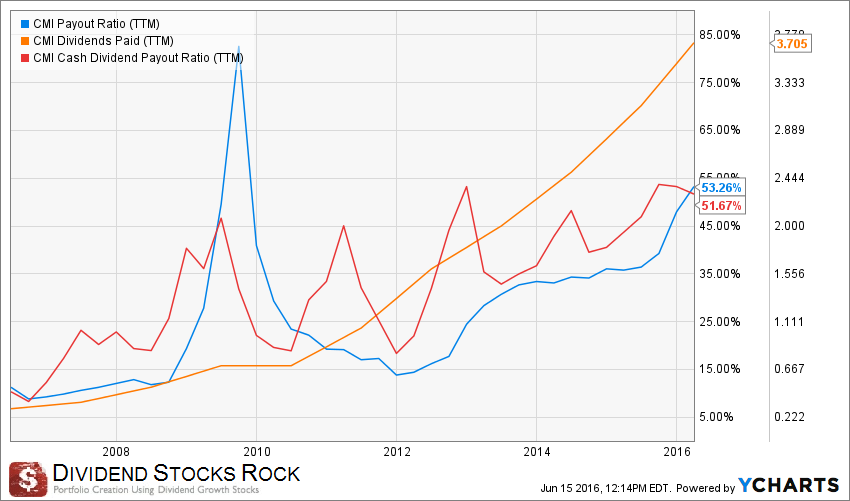

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

While the company has been increasing their dividend aggressively over the past 5 years, you can see that this wasn’t an operation to simply look good. Management was able to maintain both the payout ratio and cash payout ratio under 50% until recently. It would be unrealistic to expect a double digit dividend growth rate forever. The company has simply positioned itself in the dividend basket to attract more investors. Further on, we can expect a slower but solid dividend growth rate.CMI meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

Cummins sells consumable products with a strong brand name. The best part is that there is an important evolution in most of its products. The company is the largest manufacturer of natural gas and hybrid bus engines in the USA. As environmental regulations move forward, we will see an increase in the demand for such products. Being a leader in a changing industry is a very good thing only if you can put the money in R&D to make sure you follow the trend.

What Cummins does with its cash?

The company increased its operating cash flow from $173M to $263M for their first quarter of the year. This improvement was due to lower working capital required. As previously mentioned, management has been quite generous with its shareholders and a good part of CMI cash flow went into dividend payments.

The company increased its operating cash flow from $173M to $263M for their first quarter of the year. This improvement was due to lower working capital required. As previously mentioned, management has been quite generous with its shareholders and a good part of CMI cash flow went into dividend payments.

Besides paying back its shareholders, CMI has also used a lot of money to improve its products and remain the leader in low emission engines. This is how they will remain on the top of their game and gain additional market share in the future.

CMI has a strong business model and meets my 4th investment principle.

CMI has a strong business model and meets my 4th investment principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is some evaluation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

Source: data from Ycharts.

As is the case with most industrials, CMI is demonstrates a cyclical PE ratio depending on which environment it evolves. The company recently saw its PE going up as earnings dropped faster than its price due to slower demand. Nonetheless, I don’t think that such a strong company is overvalued at a 15 PE ratio.

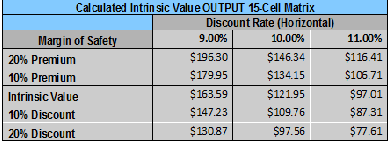

I’ve also used the dividend discount model to give a more precise value to CMI with a dividend growth investor perspective. As I’ve mentioned before, I don’t expect CMI to keep up its double digit dividend growth policy. This is why I’ve used an 8% growth rate for the first 10 years and dropped it to 6% for the years after. Since the company is evolving in a cyclical industry and is dependent on other cyclical industries such as mining, I’m using a 10% discount rate.

Input Descriptions for 15-Cell Matrix INPUTS

Enter Recent Annual Dividend Payment: $3.92

Enter Expected Dividend Growth Rate Years 1-10: 8.00%

Enter Expected Terminal Dividend Growth Rate: 6.00%

Enter Discount Rate: 10.00%

Enter Recent Annual Dividend Payment: $3.92

Enter Expected Dividend Growth Rate Years 1-10: 8.00%

Enter Expected Terminal Dividend Growth Rate: 6.00%

Enter Discount Rate: 10.00%

Here’s what the calculation give me:

As the stock is currently trading around $113, we have a small discount as its intrinsic value should be more around $121. Considering both analysis, CMI meets my 5th investing principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are no longer valid, I sell and never look back.

Investment thesis

An investment in CMI is based on its ability to protect its know-how in designing more eco-friendly engines. New markets are slowly but surely opening to Cummins due to this specific expertise. Europe in the upcoming years and later China & India will also improve their environmental rules with regards to emissions. They will then open the doors to companies such as Cummins to benefit from their expertise. CMI has already created partnerships with important clients such as TATA in India.

An investment in CMI is based on its ability to protect its know-how in designing more eco-friendly engines. New markets are slowly but surely opening to Cummins due to this specific expertise. Europe in the upcoming years and later China & India will also improve their environmental rules with regards to emissions. They will then open the doors to companies such as Cummins to benefit from their expertise. CMI has already created partnerships with important clients such as TATA in India.

It is very difficult for its competitors to catch up on 10 years of massive R&D investments to develop such technology. This is how Cummins should keep its competitive advantage for a while. An investment in CMI right now, is also an investment in a lowered valued stock paying a healthy dividend around 3.50%.

Risks

Nothing is perfect for Cummins and it will face additional competition in the future. One of its largest clients, Paccar started to sell its own engine in North America. This has obviously slowed down CMI’s growth potential in the US while also hurting its margins.

Nothing is perfect for Cummins and it will face additional competition in the future. One of its largest clients, Paccar started to sell its own engine in North America. This has obviously slowed down CMI’s growth potential in the US while also hurting its margins.

The company also might have to make partnerships with Chinese companies to conquer this market. While this is very positive for the future growth of the company, CMI might also put at risk its best asset: intellectual property. They will have to remain very cautious about their offshore partnerships.

Overall, there is more goods than bad and CMI meets my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or higher fluctuations with a greater growth potential.

Cummins is clearly a good holding for a core portfolio. They will continue to pay a steady and increasing dividend but the stock growth is limited. While I would not buy CMI as my first stock for a portfolio, Cummins offer a great addition for a stable conservative portfolio. CMI is a core holding.

Final Thoughts on CMI– Buy, Hold or Sell?

Considering the very few opportunities in the current market, I think CMI could be a good addition for any dividend growth investors. Don’t expect to see the stock skyrocket in the upcoming year, but you can rest assured to receive an increasing dividend payment. I’m not overly confident in the company’s growth perspective, but I would gladly give them a moderate buy rating. What do you think?

Disclaimer: I do not hold CMI in my Dividend Stocks Rock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.