Summary:

- Aflac revenues have suffered from the strong US currency over the past 3 years. Now that the biggest part of the USD impact is behind us, AFL might post some interesting numbers.

- Aflac benefits from a strong core business in Japan, but sales growth won’t be astonishing in the upcoming years due to low interest yield in that country.

- Aflac shows all the characteristics of a strong core dividend growth portfolio holding. However, it looks overvalued.

DSR Quick Stats

- Sector: Financial (Financial Services)

- 5 Year Revenue Growth: 0.13%

- 5 Year EPS Growth: 3.51%

- 5 Year Dividend Growth: 6.75%

- Current Dividend Yield: 2.67%

What Makes Aflac (AFL) a Good Business?

AFLAC Incorporated (NYSE: AFL) is a large international supplemental insurer. They provide cash that can cover several types of expenses to those receiving payouts due to illness or death. This is supplementary to primary medical insurance which helps cover medical expenses but leaves other expenses without a solution. This Fortune 500 company was founded in 1955, and has a large presence in Japan and the US. AFLAC stands for the American Family Life Assurance Company.

The company made a big move in Japan in the 1970s by selling insurance against the risk of cancer when people were becoming particularly mindful of cancer. Decades later, approximately three-quarters of Aflac’s diverse premiums now come from Japan.

Aflac primarily targets places of employment for its insurance products, rather than individuals outside of work. The company offers plans to employers that allow them to provide Aflac insurance as part of their benefits package to employees without paying any cost themselves.

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, hold a great deal of assets that, over time, are paid out for client losses. An insurance company constantly receives premiums and pays out for losses, so as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. Aflac invests its collected of assets primarily in fixed income securities to receive upwards of $3.4 billion in annual investment income.

Ratios

Price to Earnings: 10.21

Price to Free Cash Flow: 3.7

Price to Book: 1.418

Return on Equity: 14.24%

Price to Free Cash Flow: 3.7

Price to Book: 1.418

Return on Equity: 14.24%

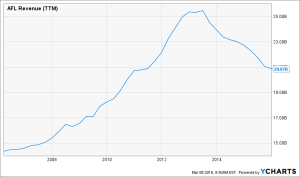

Revenue

Revenue Graph from Ycharts

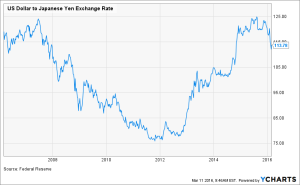

It is no surprise that revenues are down since 2013. The company makes 75% of its revenue in Japan. The USD/YEN has just been terrible for Aflac:

Source: ycharts

We can expect a lower currency impact moving forward.

How AFL fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

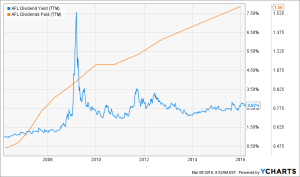

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

Aflac has kept a dividend yield between 2.50% and 3.50% since the financial crisis. At the same time, the dividend payment has never stopped increasing. This is a very good sign to see a company showing a relatively stable yield with a strong trend of payment increases. There are no signs the dividend payment is at risk for now.

AFL meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Aflac is part of the selective group of dividend aristocrats. These companies have successfully increased their dividend for at least 25 consecutive years. AFL is now showing 33 years of consecutive dividend increases. Over the past 5 years, the company has increased its payout by 6.75% CAGR making its dividend payment double every 10 years on average.

AFL meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

Source: data from Ycharts.

With a loyal client base, this company is an impressive cash flow machine. You can see how the company is keeping a very low payout ratio, but an even lower cash payout ratio. The dividend payment is set for continuous growth for many years. It’s not by chance that AFL became a dividend aristocrat. The management team is very cautious with its cash flow and makes sure the dividend growth will continue.

AFL meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

Aflac has a notable business model. Rather than targeting individuals, Aflac insurance agents target businesses. Aflac works with employers to give employees the option to purchase Aflac Insurance via payroll deductions, similar to their other benefits. This “cluster-selling” technique keeps costs comparatively low, and gives the company a major competitive price advantage. It creates a win-win situation with employers it does business with.

By focusing on supplemental insurance for illnesses such as cancer, the company has hit an ever growing niche for now. The company enjoys strong cash flow coming from Japan as it enjoys a great brand recognition. This should help the company to increase its presence in the USA in the upcoming years. Growing in the States will ultimately hurt its margin, but the company need to find another growth driver.

In my opinion, Aflac doesn’t own the strongest business model. Other competitors could hit AFL on the cancer insurance playground to slow the company down. Because of its expertise in its niche, AFL currently meets my 4th investing principle but it needs to be on the watch list.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings put aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

As you can see, there used to be a hype around AFL a few years ago in terms of stock valuation. The market used to pay a higher multiplier (up to 19 at its peak) over the past 10 years. After 2012, this is another story as the USD currency gained strength and hurt AFL revenues over the past 3 years. The stock price looks cheap overall if we compared to its multiple prior to 2008. However, this doesn’t tell me much about its current and future value. This is why I’m also using a double stage dividend discount model:

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $1.64 |

| Enter Expected Dividend Growth Rate Years 1-10: | 6.75% |

| Enter Expected Terminal Dividend Growth Rate: | 5.00% |

| Enter Discount Rate: | 9.00% |

Since the company evolves in a very stable environment, I use a 9% discount rate. I’ve selected a 6.75% growth rate for the next 10 years which is a similar rate to what the company showed in the past 5 years. However, I reduced it to 5% afterward to keep a conservative valuation.

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $79.78 | $59.51 | $47.37 |

| 10% Premium | $73.13 | $54.55 | $43.42 |

| Intrinsic Value | $66.48 | $49.59 | $39.47 |

| 10% Discount | $59.84 | $44.63 | $35.53 |

| 20% Discount | $53.19 | $39.68 | $31.58 |

Unfortunately, the company stock appears to be overvalued by 20% at the moment. I would need to increase my dividend growth rate after 10 years from 5 to 6% in order to have a fair value. If the company shows a stronger dividend growth potential, then it seems to be at best fairly valued.

AFL doesn’t meet my 5th investing principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found one of the biggest investor struggles is to know when to buy and when to sell their holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchased shares of a company are not valid anymore, I sell and never look back.

Investment thesis

Aflac works in a very interesting niche. A while ago, AFL specialized in supplemental policies for specific diseases and illnesses. Since it was a side product for many insurers, Aflac was able to developed an expertise and grow this business under the radar of many. Today, the company benefits from cheaper pricing and strong underwriting margins since they know their markets and are able to assess their risk better than any other companies in this specific niche.

Second, Aflac’s main core business comes from Japan. This country generates 75% of its revenue. What is interesting is that 95% of Japanese keep their policy and the average “client’s life” with Aflac products is 20 years. This means a lots of premiums paid each month! More recently, Aflac was able to enter into banks and post offices to sell their products, two places where the Japanese are used to purchasing such products. This should help support their sales in the upcoming years.

Risks

The deregulation in Japan that enabled AFL to enter banks and post offices doesn’t only bring sweet candies. There is a sour taste to it. In fact, this deregulation also enabled other insurance companies to compete directly with Aflac on its own ground. While the company has built a strong expertise in its niche, it won’t be long before other businesses will do the same.

While the company is pretty strong in Japan, it is another story in the US. It is harder for AFL to keeps its client (75% of Americans tend to switch policies at one point in time). This leads to inevitable margin reduction.

Aflac has a sound business model and meets my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or greater fluctuations with an improved growth potential.

Aflac is a dividend aristocrat evolving in a relatively conventional market. I believe the company will be able to grow its revenues and earnings but will definitely not explode at one point in time. This why I believe AFL should be part of a core portfolio.

Final Thoughts on AFL – Buy, Hold or Sell?

Overall, I think a purchase of AFL is a purchase of a solid and increasing dividend. However, do not expect anything else from AFL for the upcoming years. In comparison, the stock price rose 10% over the past 5 years while the S&P 500 rose 52%.

Then again, AFL is a very strong core portfolio holding showing clockwork dividend increase potential. I think that at this point, AFL is a hold.

Disclaimer: I hold AFL in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]