Abbott Laboratories (ABT) engages in the discovery, development, manufacture, and sale of health care products worldwide. This dividend champion has boosted distributions for 40 years in a row. The company’s last dividend increase was in February 2012 when the Board of Directors approved a 6.30% increase to 51 cents/share. The company’s peer group includes Johnson & Johnson (JNJ), Bristol Myers Squibb (BMY) and Merck (MRK). Over the past decade this dividend growth stock has delivered an annualized total return of 8.30% to its shareholders.

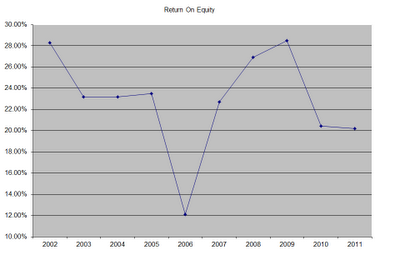

The return on equity has remained above 20% over the past decade, with the exceptions of a brief decline in 2006. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

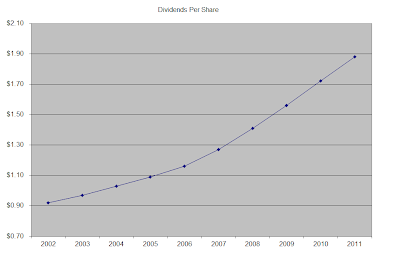

The annual dividend payment has increased by 8.70% per year over the past decade, which is higher than the growth in EPS.

A 9% growth in distributions translates into the dividend payment doubling every eight years on average. If we look at historical data, going as far back as 1983, one would notice that the company had managed to double distributions every six years on average. The dividend payout ratio has mostly remained above 50%, with the exception of a brief decline in the 2008 – 2009 period. Based on forward earnings, the company’s dividend payout ratio will likely decrease below 50%. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently Abbott is attractively valued at 15.90 times earnings, yields 3.20% and has a sustainable distribution. I recently added to my position in the stock.

Full Disclosure: Long ABT, JNJ

Relevant Articles:

- Six Notable Dividend Stocks Giving Raises to Shareholders

- Abbott Laboratories is Cheaper than you think

- Investors Get Paid for Holding Dividend Stocks

- Strong Brands Grow Dividends

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].