Summary

- Here is a company with over 100 years of experience paying a 6%+ yield.

- Management aims for a 5-9% annual distribution increase for years to come.

- At the current price, BEP shows a strong upside potential along with a healthy dividend. What’s not to like?

If you think that you have missed the mini-market correction because the S&P 500 rapidly bounced back, think again; there is plenty of opportunity lying right in front of you. One of them is Brookfield Renewable Partners LP (BEP) or (BEP.UN.TO).

Investment Thesis

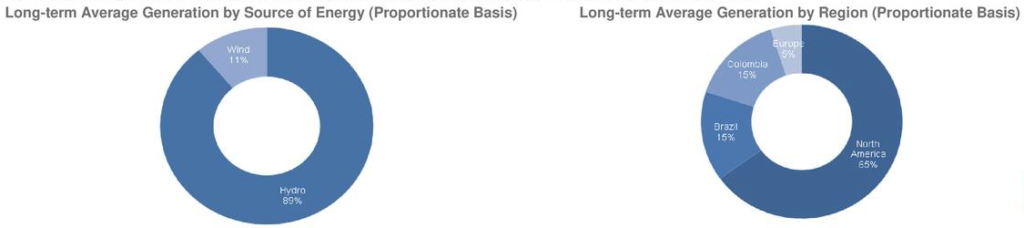

I truly believe the future of energy will be found across hydroelectric, solar, and wind power. 80% of BEP’s portfolio is focused on hydroelectric power. The company has power plants across North America, South America, Europe, and Asia. BEP enjoys large scale capital and expertise to manage its projects across the world. Management aims at a 5-9% annual distribution increase for years to come. At the current price, BEP shows a strong upside potential along with a healthy dividend. What’s not to like?

Understanding the Business

The company is a rare pure play in the renewable energy sector. With over 2,000 employees, $27 billion in power assets and $285B in AUM, BEP is also one of the largest players in this industry. Good news; BEP is only down about 12% (as of March 14th) since the beginning of the year and it is almost trading at its early 2017 level.

Source: Q3 2017 investor presentation

While the stock is down, the company currently surfs on the renewable energy tailwind. This is not just a trendy moment – renewable energy is at the center of our future economic development.

Revenues

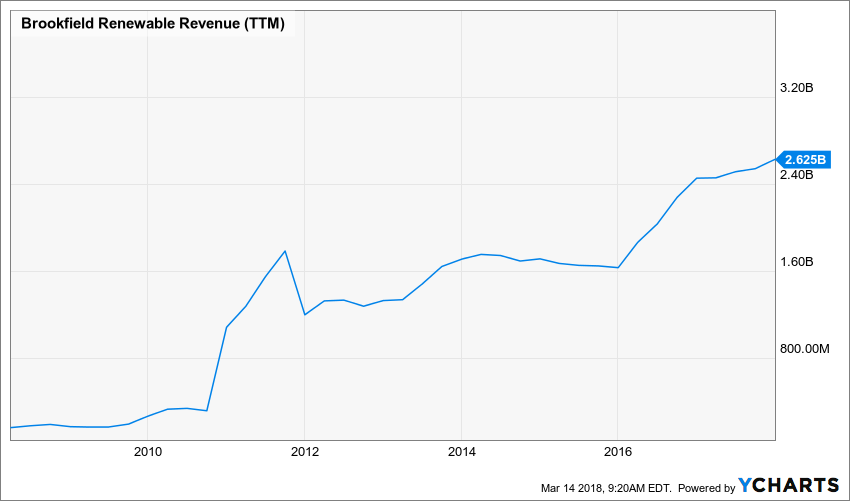

Source: Ycharts

Brookfield Renewable Partners strategy uses both organic and acquisitions to boost its revenue. Their goal is to “acquire a renewable power assets and businesses that below intrinsic value, finance them on an investment grade basis, and optimize cash flow and value utilizing our depths of operating expertise,” says CEO Sachin Shah.

The company currently has around $1.5 billion in cash for future investments. As the M&A market is currently boiling, you can expect management to use its liquidity to fund further projects. Over the years, management has developed a strong expertise in such deal. Therefore, I am confident this money will be used wisely to the great pleasure of shareholders.

Check this out.

Check this out.

Dividend Growth Perspective

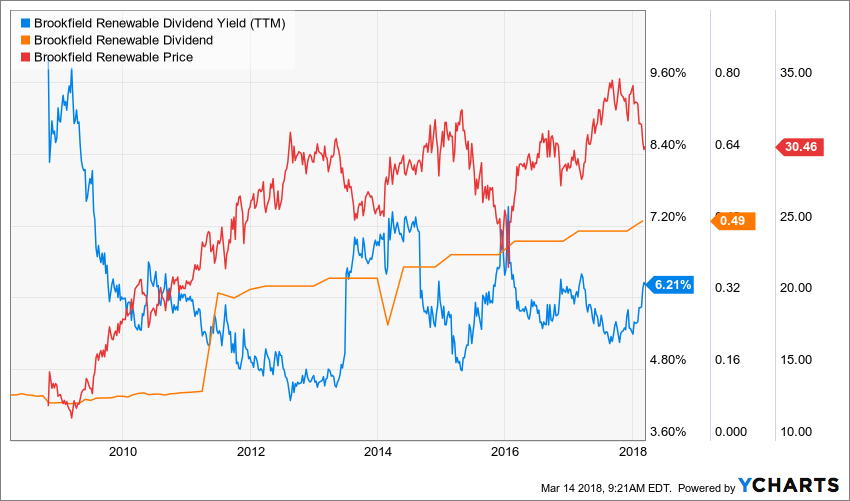

On its website, BEP shows its distribution history since 2011. The company has successfully increased its payout since then. The small dent in 2014 was due to a change of date in the dividend payment. Therefore, the February payment (which was supposed to be the March payment) was pro-rated (2/3 of the regular dividend). BEP doesn’t qualify as a dividend achiever, but still shows a great dividend profile.

The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

Source: Ycharts

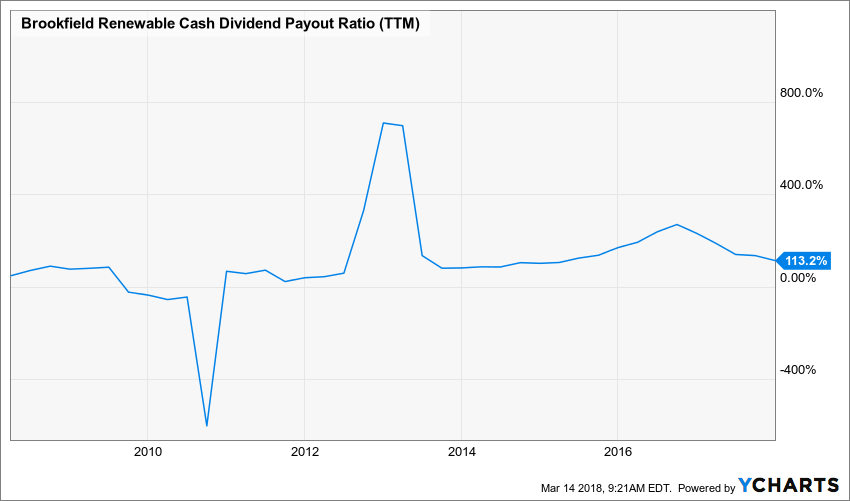

Using the classic payout ratio (and even the cash payout ratio) is not useful to determine BEP’s dividend sustainability. You are better off using the FFO/units. Over the past 5 years, BEP has maintained an 8% FFO/units CAGR while increasing its dividends by 6%. If you want to know more about how to assess MLP’s, I suggest this guide.

However, since 2016, its generosity pushed the FFO payout ratio to around 98%. In 2017, the FFO/unit was $1.90. Considering the most recent dividend increase (now $1.96 per year per unit) and an FFO growth of 8% ($2.05), the 2018 payout ratio will become 96%. This is well over management’s target of 70%.

Potential Downsides

As this kind of company is growing mostly through leverage, the debt level is always an issue. BEP currently shows nearly $11 billion in long term debt. As interest rates rise, this will impact BEP future profitability.

The second concern could be put toward future dividend growth. With a FFO payout ratio near 100% and management target around 70%, it will become difficult to maintain a steady dividend hike and reach a lower payout ratio at the same time. However, as long as the FFO grows around 8% per year, you can expect a 5-6% dividend growth.

Valuation

In order to determine BEP’s fair value, I’ve used the dividend discount model. I used a 6% dividend growth rate for the next 10 years. While there is a risk BEP doesn’t match my assumption due to the high payout ratio, I still consider this number as the company showed more commitment to increase its payouts than keep its FFO payout ratio in order.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.96 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 6.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $66.94 | $53.40 | $44.37 | |

| 10% Premium | $61.36 | $48.95 | $40.68 | |

| Intrinsic Value | $55.79 | $44.50 | $36.98 | |

| 10% Discount | $50.21 | $40.05 | $33.28 | |

| 20% Discount | $44.63 | $35.60 | $29.58 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

If some may think that I was overly optimist, I did the calculation with a 4% dividend growth rate. I kept a 10% discount rate and still find some value at the current price. In both cases, BEP is a buy.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.96 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 4.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 4.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $48.92 | $40.77 | $34.94 | |

| 10% Premium | $44.84 | $37.37 | $32.03 | |

| Intrinsic Value | $40.77 | $33.97 | $29.12 | |

| 10% Discount | $36.69 | $30.58 | $26.21 | |

| 20% Discount | $32.61 | $27.18 | $23.30 | |

Final Thought

Renewal energy should be a part of our future. Solid dividend payments should also be part of our future as investors. Therefore, you have the two best reasons in the world to consider Brookfield Renewable Partners.

Disclaimer: I do not hold BEP in my DividendStocksRock portfolios.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]