Summary

- Apple just finished another record year

- Haters gonna hate

- Shareholders gonna smile

I remember the first time I purchased shares of Apple (AAPL). At first, it was supposed to be a short-term investment as there was a timely opportunity. I bought my first shares before the split, when the stock was trading under $400 (therefore, under $57 after the 1:7 split). At that time, many rumors were going around.

A few years and over 100% return later, Apple is struck by similar bad mouth sayings.

It’s funny to see that for each Apple fan, there is probably a hater. It’s only fair. But as a serious investor, you should neither be a fan or a hater. Emotion has no place when it’s time to take a look at a stock. Now that we have set our feelings aside, let’s take a deeper look at Apple.

Understanding the Business

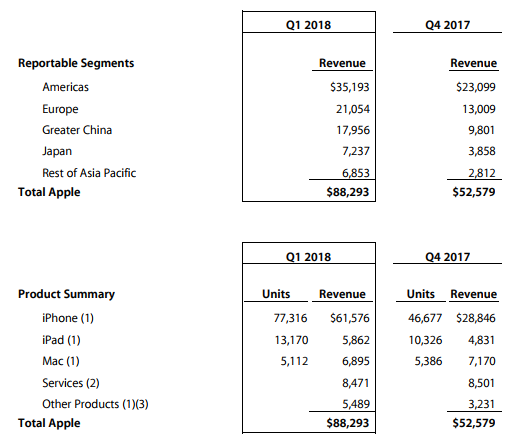

Apple has been called a one trick pony for several years and this is not entirely false. Apple is one of the largest smartphone makers in the world. But there is more than that. While AAPL iPhone represents about half of Apple’s sales, the company is building a strong “services” segment.

As you can see, Apple’s financial performances are still highly dependent on the next generation of iPhones. You can see what happens when there is a new phone on the market; quarterly sales more than doubled from Q4 2017 to Q1 2018.

The company continues to sell iPads and Macs but it’s definitely not part of the core business model anymore. The company’s main strength relies on the quality of their product and the ecosystem it builds around them. I think the Internet of Things (IoT) term come from all Apple’s devices talking to each other!

An Eye on the Latest Quarter

Non-GAAP EPS of $3.89, up by 16%, beat estimates by $0.04

Revenue of $88.3B, up by 12.7%, beat estimates by $670M.

Dividend of $0.63/share, no increase.

“We’re thrilled to report the biggest quarter in Apple’s history, with broad-based growth that included the highest revenue ever from a new iPhone lineup. iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” said Tim Cook, Apple’s CEO. “We’ve also achieved a significant milestone with our active installed base of devices reaching 1.3 billion in January. That’s an increase of 30 percent in just two years, which is a testament to the popularity of our products and the loyalty and satisfaction of our customers.”

What I Say

I’m not surprised by this record quarter. I expected strong sales for Apple’s new iPhone. There is definitely a continuous interest for premium products (at a premium price!). It seems it’s never enough for some specialists, but I will gladly hold my shares. I’m more interested to see Apple repatriate its offshore cash and how it will use it in the upcoming months.

Growth Vectors

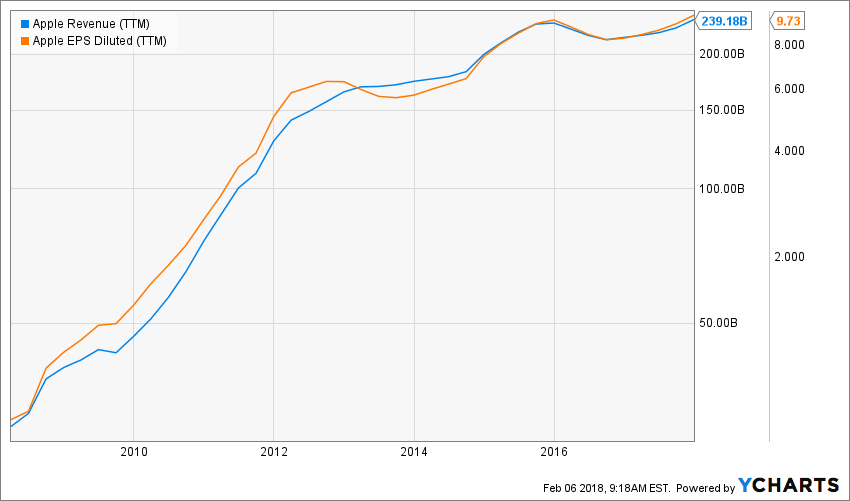

Source: Ycharts

Wow… have you seen this graph? Both revenues and earnings are going higher and higher at the same pace! Apple first growth vector remains its iPhone. Each time there is a new model coming out, the market goes a little crazy. Off course, it’s not the same hype as it was when Apple launches its iPhone 4 for example. Still, there is a continuous interest for new versions.

Second, Apple is growing its services division at a double digit pace. During their most recent quarter, this segment posted at +18% year over year growth. Services such as Apple Pay, Apple Music and Apple TV are just the beginning. The more people buy iPhones, the more they are inclined to use services attached to them.

Third, the Tax bill will make additional money available for Apple to use. I expect additional shares repurchase and dividend increase. This is definitely a plus if you are a shareholder!

Dividend Growth Perspective

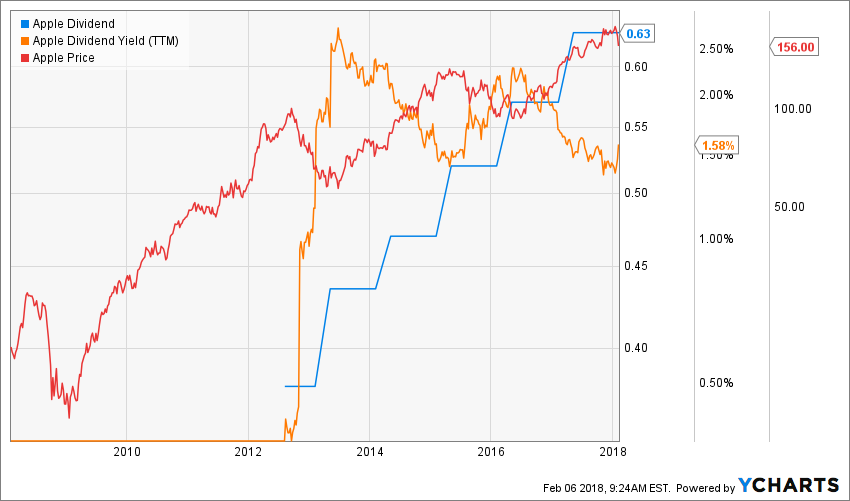

Apple shows 5 years of consecutive dividend growth. This makes it half way of making the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

During this 5 years period, AAPL shows a +66.42% total dividend growth for a 10.72% CAGR. With strong sales growth and consistent earnings progression, I expect the company to keep up with a double-digit dividend growth commitment for several years. Don’t be fooled by the 1.50% yield as the company will double its payment every 7 years going forward. AAPL meets my 7 dividend growth investing principles.

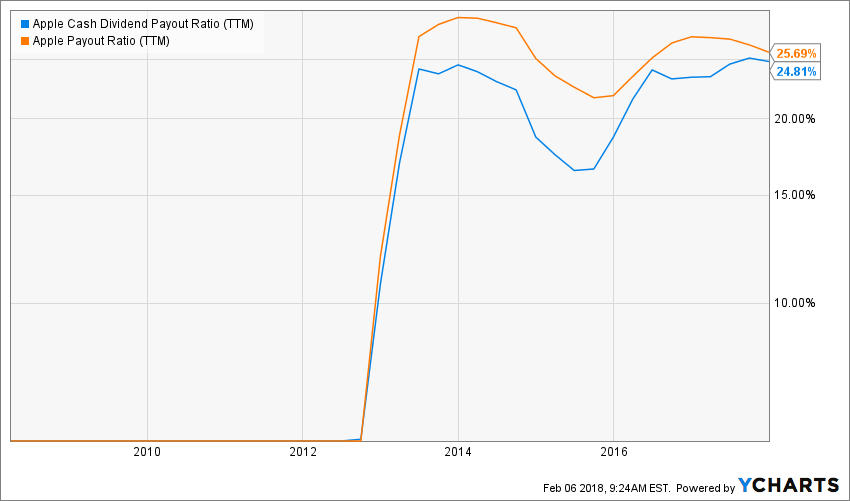

Source: Ycharts

Both payout and cash payout ratios are very low. This is another reason why I believe in a double-digit dividend growth policy for the next decade. Apple’s business model is based on generating tons of cash flow on a quarterly basis. This is exactly what I’m looking for as a dividend growth investor.

Potential Downsides

To be honest, I don’t see that many dark clouds coming over Apple’s head at the moment. The company enjoys strong growth vectors and whatever haters say about AAPL’s new iPhones or watch, the company keeps showing strong sales.

However, there are no techno companies sheltered from innovation. I think Apple protects its core product with a strong product ecosystem and additional services. Yet, the coming of a new popular phone hurting AAPL sales is always a possibility.

Valuation

What is the right price to enter in a position in AAPL? My guess would be today is the best moment after yesterday. The worst timing is tomorrow.

Source: Ycharts

The company continues to trade at reasonable levels considering its growth potential. When I use the DDM, I get a current price being slightly undervalued right now:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $2.52 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 10.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 8.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $389.63 | $193.54 | $128.23 | |

| 10% Premium | $357.16 | $177.41 | $117.54 | |

| Intrinsic Value | $324.69 | $161.28 | $106.86 | |

| 10% Discount | $292.22 | $145.15 | $96.17 | |

| 20% Discount | $259.75 | $129.02 | $85.48 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

I can’t really use a strong dividend growth rate at the moment. However, the moment management announce their 2018 dividend raise; the stock will appear undervalued by 10%.

Final Thought

As I mentioned earlier in this article, the right timing to buy Apple is always today. I think the company will continue to thrive in the upcoming years and its shareholders will be rewarded with juicy dividend raise year after year. Don’t wait until AAPL pays a 3% yield to jump on the train.

Seriously, if you made it this far, it’s because you liked what you read. Don’t be a stranger; leave a comment and tell me what you think! I’m asking you one more thing; click on “follow” button (it’s orange, you can’t miss it!) and you will get notified each time I write a great piece like this one.

Disclosure: I do hold AAPL in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]