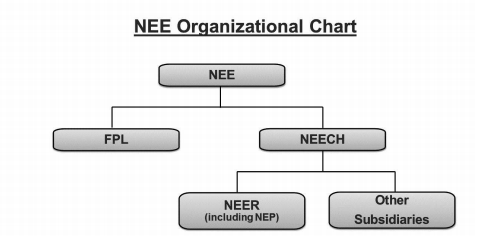

NextEra Energy is an electric power company divided into 2 different businesses: Florida Power & Light (FPL) which 89% of its customers are residential (11% commercial) and NextEra Energy Resources (NEER), a clean energy utility with 75% of its assets producing wind energy. Along with Xcel (XEL), it is a leader in the clean energy production in the U.S.

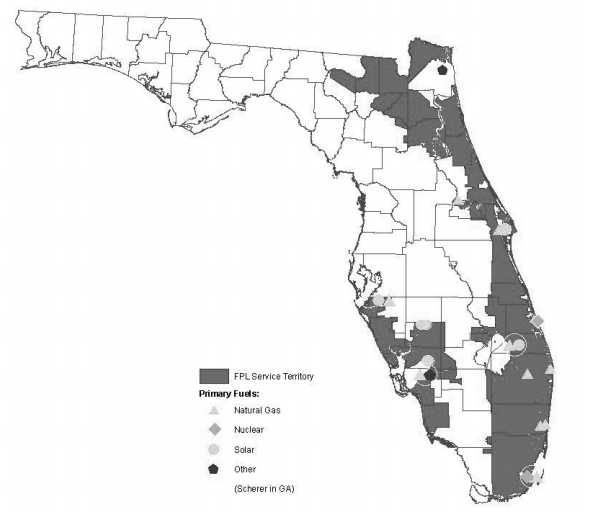

Most of FPL energy is generated through natural gas (70%) and nuclear (23%). FPL counts for 60% of NEE earnings (2016 annual report).

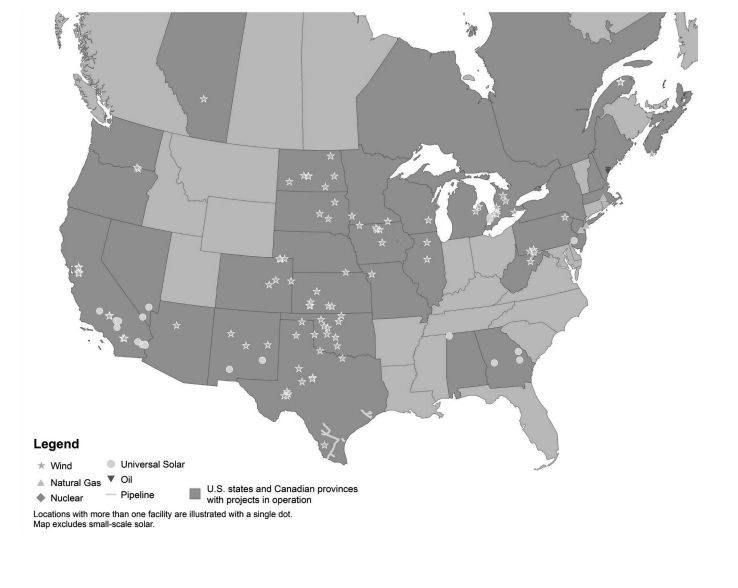

As you can see in the map above, NEER is mainly a wind energy company and it is mostly active in the central U.S., with some activities in California. As regulation around coal energy becomes more restrictive, a play in the clean energy through NEE sounds like a good idea.

Revenue

Revenue Graph from Ycharts

When I dug deeper in the revenue trend, I noticed that revenues and earnings didn’t jump between 2015 and 2016, they just receive a temporary boost as explained in its press release:

How NEE fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

When a utility shows a low yield around 2.50%, you usually find the reason behind it with the stock price. As you can see, NEE shares soared from the $50’s in 2010 to over $150 in 2017. The dividend yield remains attractive, but the stock appreciation plays a big role here.

NEE meets my 1st investing principles.

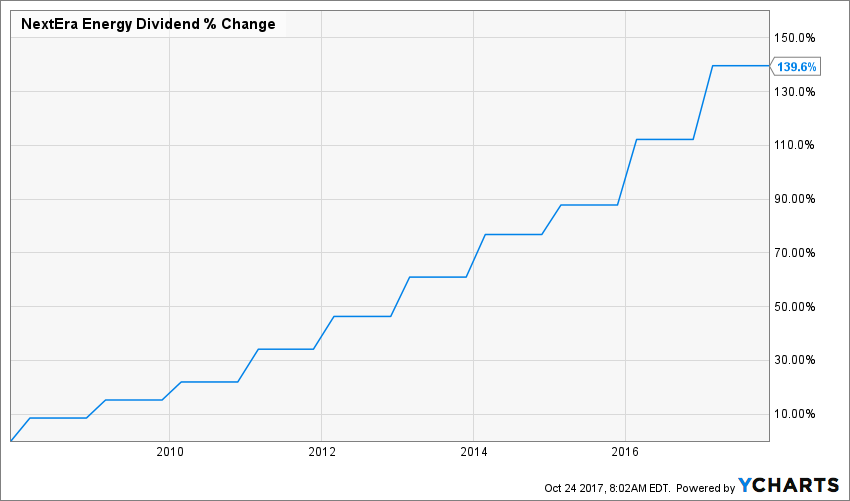

Principle #2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

NextEra Energy has successfully increased its dividend for 22 years, making it part of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

NEE meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

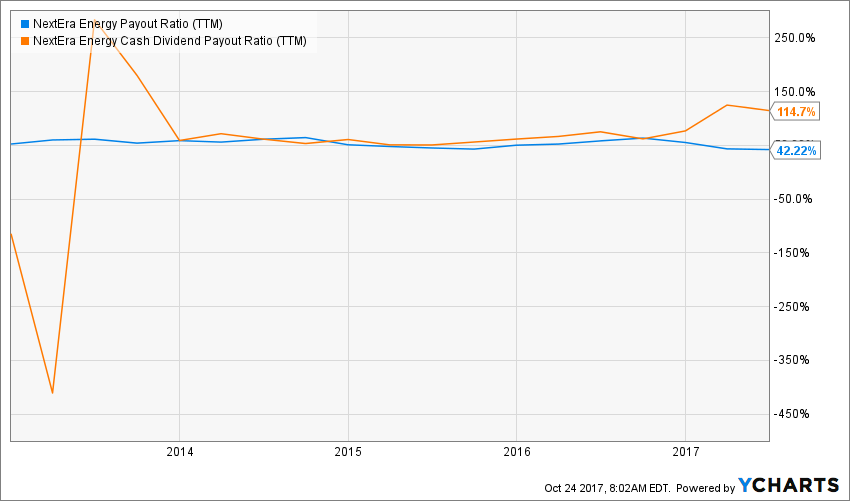

Source: data from Ycharts.

The company uses more the payout ratio than the cash payout ratio. Most utilities are known to distribute a good part of their earnings, but I would like to see a cash payout ratio under 100% going forward. At this time, the dividend payment is not at risk and management expects strong dividend growth for the upcoming years as earnings should grow at a 6-8% rate towards 2020.

NEE meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

An investment in NextEra Energy is an investment in the future. I usually appreciate the steady component in any utility business model. But with NEE, you also had a clean energy segment that will ensure growth in the future. As it will get more complicated and costly to produce energy from coal, wind and solar energy production will improve. This is where NEE will benefit from its leader position.

Also, NEE is well served in a healthy state such as Florida with FPL. This segment of business is expected to generate 7%-9% earnings growth.

On the down side, NEE faces the classic issues coming for any utility company: raising debts during a raising interest rate environment. The company must invest lots of money in its power plant, especially to make wind and solar energy even more productive. Therefore, raising debts with higher interest will obviously hit NEE margins and profitability. This could slow down its progression. In other words, do not expect the stock price to surge by another 150% in the next 10 years.

NEE still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

In term of PE valuation, I’m not ready to declare NEE as the deal of the month. However, compared to others like WEC Energy Group (WEC)(21.80), Xcel Energy (XEL) (21.77) and Duke Energy (DUK)(22.03), NEE price/earnings ratio looks like a good investment.

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I would rather see companies like a big money making machine and assess its value as such. As management is confident to post a 7%-9% earnings growth, I used an 8% dividend growth rate for the first 10 years and reduced it to 6% afterward.

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $3.93 |

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% |

| Enter Expected Terminal Dividend Growth Rate: | 6.00% |

| Enter Discount Rate: | 9.00% |

Here are the details of my calculations:

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $297.11 | $196.81 | $146.72 |

| 10% Premium | $272.35 | $180.40 | $134.49 |

| Intrinsic Value | $247.59 | $164.00 | $122.26 |

| 10% Discount | $222.83 | $147.60 | $110.04 |

| 20% Discount | $198.07 | $131.20 | $97.81 |

Source: how to use the Dividend Discount Model

According to the DDM, NextEra Energy is trading at a 7% discount. This doesn’t give much room for error, but it is still a good pick considering the overall market.

NEE meet my 5th investing principle with a potential upside of 7%.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by whether or not the company confirms my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

NEE makes the bulk of its income from a flourishing state, Florida. Going forward FPL will continue to produce steady growth. The company benefits from a territorial monopoly and enjoy economy of scale. NEE also counts on investments in clean & renewable energy through its wind and solar power plants. Those are the energy of the future and NEE has definitely taken a step forward compared to many of its peers. The company has been increasing its dividend for 22 consecutive years and management shows its commitment to continue this streak in the future.

NEE shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I might ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

As I mentioned before, I don’t expect NEE stock price to surge by another 150% in the next decade. Like any utilities, this is a better fit for a conservative or core portfolio. There will be growth, but don’t expect this company to bring your portfolio to higher levels by itself.

NEE is a core holding.

Final Thoughts on NEE – Buy, Hold or Sell?

Considering a market where everything looks overpriced, at this point an investment in NEE looks like a sound decision. There is still upside potential and the dividend payment is rock solid.

Disclaimer: I do not hold NEE in my DividendStocksRock portfolios.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]