I personally think 2017 will be a good one for the stock market. After going sideways during 2015 and the first couple of month of 2016, the economy has been put back on track with solid numbers and the stock market follows. However, after a strong bullish market since 2009, buying opportunities are getting rare. This is why a strong valuation process is important.

My Favorite Tool for Valuation

There are tons of methods to value companies. Each of them have their pros and their cons. My favorite one is the Dividend Discount Model. It helps me looking at each company as it was a money distributor (I kind of like this idea!). By discounting the value of each dividend payouts, I get an idea of how much I should pay for shares of company XYZ.

The DDM is relatively easy to use, but could sometimes be misleading if our assumptions are to optimistic. By using a low discount rate (meaning you don’t expect much return) or by boosting expected dividend growth rate, you could easily find deals everywhere on the stock market. Therefore I’m offering a small refresh on how I use it.

How to adequately select your discount rate

- geographically diversified (being a leader in several countries)

- diversified products (many billion dollar brands)

- solid balance sheet (low debt and high repayment capacity)

- unique economic moat (a competitive advantage nearly impossible to replicate)

- steady and increasing revenue streams

The Dividend Discount Model – 3 Undervalued Companies

Clorox (CLX) Potential Gain: 43%

By definition, the discount rate should correspond to your expected rate of return. If you invest in the stock market, you should expect a minimal return of 7-8%. However, if you use such a low discount rate to make up a value using popular models such as the Discounted Cash Flow analysis or the Dividend Discount Model, you will find that pretty much all dividend growth stocks are trading at a discount. This is not true either.

I try to become more selective in my approach. This is why I use a discount rate between 9% and 12%. When a company is in stellar condition, I will use the 9% discount rate. However, this company must show most of the following criteria:

Such companies can be found but they are rare. Most of the time, I find a solid company showing most of those criteria, but there is always something leading me to use a higher discount rate. This is why I pick 10% as a default discount rate. I use 1% less (9%) for exceptional companies and 1% over (11%) for riskier companies. Rarely, but sometimes it happens, I use a 12% discount rate when I think the company has a strong upside potential but also shows some serious issues. I tend to never have more than 10% of my portfolio invested in such companies.

When I see investors using an 8% discount rate, I find it’s not greedy enough. I think they put their investment at risk thinking all their investment will reward them with a 8% return. We all know this is not true and you need stronger picks to compensate. This is why using a 10% discount rate will push many companies aside at the valuation stage.

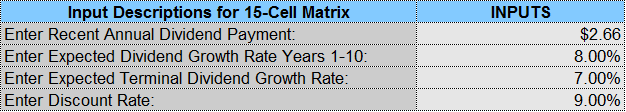

A similar thinking should be applied toward dividend growth rates. I like using the double stage dividend discount model calculation as I can use 2 different rates. A first one that will be good for the first 10 years and another one that will be used forever after. The first rate could be more generous if it reflects the current situation of a company. When a business is growing in a flourishing economy, we can believe it will become more generous with its shareholders for the time being. After that, it is time to become more reasonable and expect a more conservative rate. The idea is to find the balance between the past 5 years that has simply been amazing and the next 25 years where we can’t really know what will happen.

In order to illustrate how I use the double stage dividend discount model (you can check the excel spreadsheet here), I selected 3 companies with undervalued share prices. Those will be a good start for your potential buy list for 2017.

The reason an investor would pick CLX to be part of his portfolio is somewhat obvious: it is an ever increasing dividend stock. Clorox is part of the selective group of dividend aristocrats that has increased its dividend for at least 25 years consecutively. In 2016, they have reached their 39th consecutive year with a dividend raise.

The company goals are to support a 3-5% organic sales, improve margins by 25 to 50 bps and to generate free cash flow of 10-12% of sales.

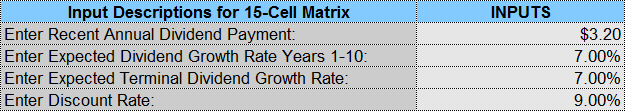

Calculation:

Results:

Lowe’s (LOW) Potential Gain: +30%

Focus on a recovering U.S. economy and additional growth from acquisitions should continue to push LOW’s stock price higher. Its strong brand and the way it helps its customers to go through bigger projects by offering a “one-stop-shop-&-advice” service will secure LOW’s market share and improve margins over the long haul. Lowe’s has been able to transform a simple home product store into a great service offering for home projects. There is definitely more room for growth in the upcoming years.

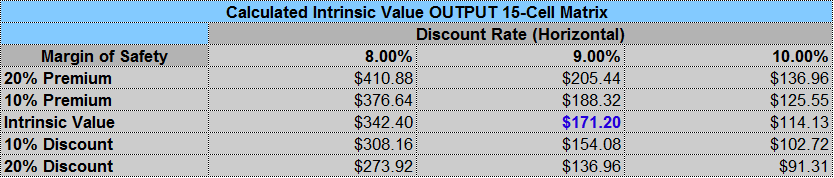

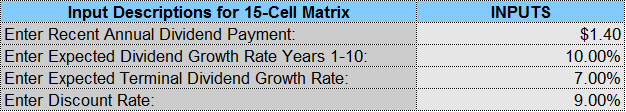

Calculation:

Results:

Source: Dividend Toolkit Spreadsheets

Honeywell (HON) Potential Gain +32.5%

Honeywell has made impressive efforts to improve their internal practices over the past 15 years after failing to merge with General Electrics (GE). Those efforts paid well as the company operating margins improved from 7.6% in 2004 to 15.2% in 2014. Those impressive margin increase lead HON EPS to increase by 10% in 2015 as the company is facing a challenging economy. The company was also able to increase its dividend by 10% CAGR over the past 5 years. HON is a leader in the aerospace control and safety systems and should benefit from its leadership position during the commercial aircraft upcycle.

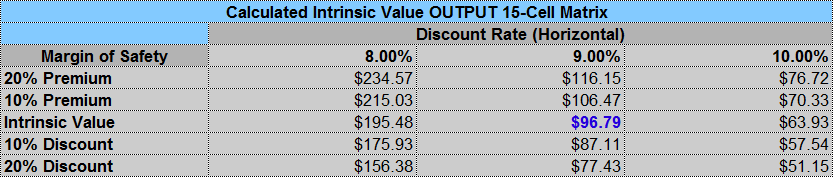

Calculation:

Results:

Source: Dividend Toolkit Spreadsheets

Disclaimer: I hold CLX and LOW in my dividendstocksrock portfolios.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]