Omega Healthcare Investors (OHI) invests in healthcare facilities, principally long-term healthcare facilities in the United States. It provides lease or mortgage financing to qualified operators of skilled nursing facilities , as well as to assisted living facilities , independent living facilities, and rehabilitation and acute care facilities. This real estate investment trust has raised dividends for ten years in a row. Back in March, I initiated a position in Omega Healthcare Investors and Digital Realty Trust (DLR), after I sold my position in Universal Healthcare Realty Investors (UHT).

One of the reasons why I have been hesitant to look at Omega Healthcare before, was the fact that the REIT cut distributions in 2000, and eliminated them for 2001 and 2002. The risk with a company that eliminates dividends once, is that the conditions might appear again, thus causing the firm to become a repeat dividend cut offender. In this article, I will review the operating performance over the past decade, and conclude on whether the company is a good addition to an investor’s portfolio.I will evaluate this REIT using the five criteria I use as outlined in an earlier article this week.

Since 2005, FFO has grown by 150%, while the dividend has doubled in the same period.

I usually prefer a margin of safety in dividend payments. At 82%, the FFO Payout ratio is sustainable. A lower payout is always a plus, because it allows the company to absorb any short-term fluctuation in FFO, which lowers risk to dividend payments.

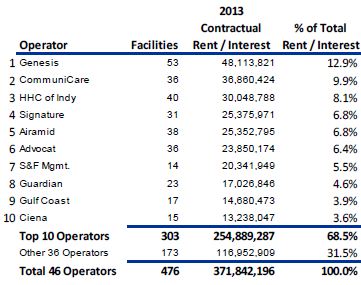

The ten largest tenants account for 68% of revenues.

Currently, I find Omega Healthcare Investors to be attractively valued at 15.50 times FFO and yielding 5.70%.

Relevant Articles:

- Spring Cleaning My Income Portfolio, Part II

- Margin of Safety in Dividends

- Four High Yield REITs for current income

- National Retail Properties (NNN) Dividend Stock Analysis

- Dividend Achievers Offer Income Growth and Capital Appreciation Potential

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].