Recent Posts From DIV-Net Members

-

How to determine if your dividends are safe - As dividend growth investors, our goal is to buy shares in a company that will shower us with cash for decades to come. One of the important things to lo...18 hours ago

-

Multiple Income Sources - It’s important to have multiple income sources. That way, if one dries up, you have others to rely on. This is one way to achieve FI (financial independe...20 hours ago

-

Trudeau and His Minions Continue to Destroy Canada’s Economy - In this latest budget, it’s clear that Trudeau and His Minions Continue to Destroy Canada’s Economy. 10’s of Billions of new borrowing and spending. They...1 day ago

-

How To Plan Your Month in 10 Simple Steps - Essential Things To Do At The Start Of Every Month The beginning of the month offers an excellent opportunity to get organized. Furthermore, planning you...1 day ago

-

Travelers Dividend Increase - Travelers (TRV) increased its quarterly dividend by 5.00%, from $1.00 to $1.05 per share. The dividend will be paid on 28 June to shareholders of record...5 days ago

-

United Parcel Service, Inc. (UPS) Dividend Stock Analysis - Linked here is a detailed quantitative analysis of United Parcel Service, Inc. (UPS). Below are some highlights from the above linked analysis: Company Des...6 days ago

-

Introducing Wall Street Data Solutions, a revoluti... - Introducing Wall Street Data Solutions, a revolutionary platform designed to empower traders with real-time market insights, expert analysis, and personali...3 weeks ago

-

Monthly Income Update – December 2023 - Dear Readers, I wanted to wish y’all a Very Happy New Year! I hope you had time to enjoy the holidays with your family, friends and loved ones, and are now...3 months ago

-

2022 Week 46 investing and trading report - I feel like the markets are easing their bearish stance. They are still extremely volatile and choppy intraday, but we are poised for a rally that may la...1 year ago

-

2020 Q1 Dividends - $430.58 - The markets have been in turmoil and I have seen my investments drop by 20%. My standard reply to market volatility has been that I don’t care because I ...2 years ago

-

Portfolio Update – March 2021 – $1,000 per month! - I am a little shocked, and disappointed in myself, that it has been almost eight months since my last post. The timing makes sense though: I went back to s...2 years ago

-

Passive Income for July 2020 - Once a month, I like to talk about my total passive income for the previous month. I do this to track how much passive income is coming in. When I start ...3 years ago

-

Portfolio Update May 2020 - It is time to give a new update about my current portfolio. April has shown some recovery of my portfolio and also of my dividend … The post Portfolio Up...3 years ago

-

Dividend Stocks That Broke Out with the S&P 500 and NASDAQ This Week - Note: This page contains affiliate links for certain services and products. I may receive compensation at no additional cost to you when you click on th...4 years ago

-

Cardiovascular Systems - Cardiovascular Systems, Inc., a medical technology company, develops, manufactures, and markets devices to treat vascular diseases in the United States. Th...5 years ago

-

Buy: ABBV - Today I added a new position: ABBV. They didn't show up on my screener because some spin-off activity made it look like their div history is much shorter t...7 years ago

Stock Analysis: Microsoft Corporation (MSFT)

Company Description: Microsoft, the world's largest software company, develops PC software, including the Windows operating system and the Office application suite.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description:

1. Avg. High Yield Price

2. 20-Year DCF Price

3. Avg. P/E Price

4. Graham Number

MSFT is trading at a discount to 1.), 2.) and 3.) above. The stock is trading at a 22.3% discount to its calculated fair value of $35.08. MSFT earned a Star in this section since it is trading at a fair value.

Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description:

1. Free Cash Flow Payout

2. Debt To Total Capital

3. Key Metrics

4. Dividend Growth Rate

5. Years of Div. Growth

6. Rolling 4-yr Div. > 15%

MSFT earned two Stars in this section for 1.) and 2.) above. A Star was earned since the Free Cash Flow payout ratio was less than 60% and there were no negative Free Cash Flows over the last 10 years. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%. The company has paid a cash dividend to shareholders every year since 2003 and has increased its dividend payments for 9 consecutive years.

Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description:

1. NPV MMA Diff.

2. Years to > MMA

MSFT earned a Star in this section for its NPV MMA Diff. of the $5,600. This amount is in excess of the $2,600 target I look for in a stock that has increased dividends as long as MSFT has. If MSFT grows its dividend at 14.3% per year, it will take 2 years to equal a MMA yielding an estimated 20-year average rate of 3.6%. MSFT earned a check for the Key Metric 'Years to >MMA' since its 2 years is less than the 5 year target.

Memberships and Peers: MSFT is a member of the S&P 500. The company's peer group includes: Apple Inc. (AAPL) with a 0.0% yield, Oracle Corp. (ORCL) with a 0.8% yield and Google Inc. (GOOG) with a 0.0% yield.

Conclusion: MSFT earned one Star in the Fair Value section, earned two Stars in the Dividend Analytical Data section and earned one Star in the Dividend Income vs. MMA section for a total of four Stars. This quantitatively ranks MSFT as a 4 Star-Strong stock.

Using my D4L-PreScreen.xls model, I determined the share price would need to increase to $36.47 before MSFT's NPV MMA Differential decreased to the $2,600 minimum that I look for in a stock with 9 years of consecutive dividend increases. At that price the stock would yield 2.2%.

Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $2,600 NPV MMA Differential, the calculated rate is 11.7%. This dividend growth rate is lower than the 14.3% used in this analysis, thus providing a margin of safety. MSFT has a risk rating of 2.00 which classifies it as a Medium risk stock.

MSFT is facing several challenges. The company has experienced market share losses in smartphones and mobile devices, and faced difficulties in releasing new products in a timely manner. In addition, the market shift to web-based applications threatens MSFT's Windows PC operating system. However, the cloud movement will provide new opportunities in the deployment and delivery of cloud-based software services. MSFT's server and business application software products are positioned to benefit from the cloud computing.

With strong free cash flow and low debt, the MSFT in an enviably strong financial position. Not to be overlooked, the company ended it fiscal 2011 with over 10 times it dividend in cash and short-term receivables sitting on its balance sheet. With its most recent dividend increase, my analysis indicated that MSFT was a buy below its calculated fair value price of $35.08. I recently initiated a position in the stock, and will look to add to it as market conditions and my allocation allows.

Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information.

Full Disclosure: At the time of this writing, I was long in MSFT (0.9% of my Dividend Growth Portfolio). See a list of all my dividend growth holdings here.

Related Articles:

- ConocoPhillips Co. (COP) Dividend Stock Analysis

- Johnson & Johnson (JNJ) Dividend Stock Analysis

- Medtronic Inc. (MDT) Dividend Stock Analysis

- Walgreen Co. (WAG) Dividend Stock Analysis

- More Stock Analysis

This article was written by Dividends4Life. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Weekend Reading Links - October 30, 2011

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Articles From DIV-Net Members

Continue Reading »

Abbott to split in two companies

Several companies I own have announced that they plan on splitting in two separate entities. Abbott Labs (ABT) was the latest one to announce its intentions to split in two companies. Check my analysis of the stock. The question in the mind of every dividend growth investor is: “What should I do”?

In general, as long as the characteristics which enabled the original company to raise dividends for decades are still intact, chances are that the separate entities will continue raising distributions. For example, Altria Group (MO) was able to spin-off Kraft (KFT) in 2007 and Phillip Morris International (PM) in 2008. Before that, the original company was able to raise annual distributions for over three decades. After the spin-offs, Altria (MO) has kept up with raising dividends to its shareholders, as did Phillip Morris International (PM). Both companies were able to increase earnings per share over the same period, which enabled them to achieve the task of higher dividends ever since.

Kraft (KFT) on the other hand has been unable to increase distributions more than once since the spin-off, due to its inability to increase earnings and due to the costs associated with the acquisition of Cadbury in 2010. Now Kraft (KFT) itself is in the process of splitting in two separate companies, the global snacks business with annual sales of $32 billion and a high margin grocery business, with annual sales of $16 billion.

Abbott Labs on the other hand is splitting in two companies. The first one will be a research-based pharmaceuticals company, which will own Abbott’s premier drug names such as Humira, Lupron, Synagis to name a few. It would be basically a drug company, which focuses on keeping its pipeline of new drugs coming to the market, through constant investment in research and development. Drug companies have faced steep patent cliffs over the past several years, which has intensified mergers in the sector.

The second company will be a diversified medical products company, and its name would remain Abbott. It would own established nutritional products, medical devices and diagnostics products as well as generic drugs outside of the US.

As a dividend growth investor, I plan on holding on to these stocks after the spin-offs. I believe that both companies would be able to better focus on their goals as standalone entities. Despite the fact that I do require a minimum of ten consecutive annual dividend increases in order to purchase new stocks, I make an exception for spin-offs. I do monitor each situation closely however, as inability to raise dividends over time would prohibit me from allocating any new capital to such positions.

Once investors receive the new shares in each of the new companies, initially I expect that the dividends in total to be equal to the total dividend paid out by Abbott. Overtime however, I expect these dividends to grow. As a result, given the fact that Abbott has had a long culture of dividend increases and the fact that it is priced attractively at the moment, I would keep accumulating the stock in my income portfolio.

Full disclosure: Long KFT, PM, MO, ABT

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Low Yield, High Growth

I'm a firm believer in the dividend growth investing strategy. One of the premises behind this strategy is to invest in stocks that pay a dividend yield that offers a solid entry point with growth of the dividend that outpaces inflation. Generally, I'll accept dividend stocks that offer an entry yield of at least 2.5% as part of my entry criteria, but I often look for at least 3% as a solid starting point. In addition, I also look for a history of growth of that dividend of at least 6% annually but prefer double digits when I can get it.

However, I'm also a person who likes to learn and stay open minded. I think it's always a good idea to expand one's horizons and stay open minded to opportunities wherever they can be found. Ultimately, I'm looking to make money when I invest and if money can be made I'm interested. Today I'd like to look at a few interesting opportunities that fall outside of my general entry criteria, but still offer potential opportunities. I'm going to look at three stocks that offer low entry yield, but very high growth. That high growth could turn what starts as a small yield into a very large yield on cost over a short period of time.

TEVA Pharmaceutical Industries Ltd (TEVA) (ADR)

Per Morningstar:

With headquarters in Israel, Teva Pharmaceutical is the world's largest generic pharmaceutical manufacturer, with operations in 60 countries. Teva operates 38 finished dosage sites, 15 research and development centers, and 21 active pharmaceutical ingredient manufacturing sites. The company also develops and sells branded pharmaceuticals, including Copaxone, one of the world's leading multiple sclerosis drugs.

TEVA is an interesting choice. Investing in TEVA means you are buying ADR (American Depository Receipt) shares, and due to such you will owe Israel taxes on your dividend. This is currently a 20% tax rate. TEVA could offer investors a great opportunity to buy into the world's largest generic pharmaceutical manufacturer. Generic drugs will be in great demand over the long-term as more and more baby boomers retire and need medication for various health issues. By buying at today's prices you'll be purchasing TEVA at a P/E ratio of 11.55 with an entry yield of 1.95%. By sacrificing the entry yield a bit you'll be landing a dividend stock that has a 5-year dividend growth rate of 22.7% and 10 years of dividend growth. It has a low debt/equity ratio of 0.2. One risk to consider with TEVA is currency risk, as you are paid dividends in Israel's native currency, which is then converted to the dollar. Also, it would be best to invest in this company in a taxable investment account so that you can get the taxes withheld by Israel reimbursed to you.

Becton, Dickinson and Co. (BDX)

Per Morningstar:

Becton Dickinson is the world's largest manufacturer and distributor of medical surgical products, such as needles, syringes, and sharps-disposal units. The company also manufactures diagnostic instruments and reagents, as well as flow cytometry and cell-imaging systems. International revenue accounts for 55% of the company's business.

BDX is another health care pick. They have a large stable of medical products that they manufacture and distribute. This stays with the theme I outlined with TEVA: baby boomers are retiring and this large and growing older demographic provides ample opportunity for some players in the health care field. I think BDX will be another winner here as hospitals aren't going out of business anytime soon. They are trading at a P/E ratio of 14 with an entry yield of of only 2.14%. That's a low yield to accept, but what about the growth. Well, they have a 5-year dividend growth rate of 15.5%. They also have 38 years of dividend growth behind them. They have a low debt/equity ratio of 0.5. I think this is another opportunity that makes up for the low entry yield with the outsized growth behind it.

Visa Inc. (V)

Per Morningstar:

Visa manages a group of global payment card brands, which it licenses to financial institutions that issue cards to their customers. The firm acts as the payment processor by facilitating the authorization, clearing, and settlement of transactions on its proprietary networks. Visa maintains the largest card scheme in the world.

Visa falls outside my normal investment criteria, and because of such, I'm only keeping a light eye on this one. I think this business has one of the most recognized brands in the world and a very solid business model. They have a cash cow business with absolutely huge margins and no debt. This is a bit of a hybrid growth/dividend stock as they have a very low entry yield of just 1%, which almost isn't even worth mentioning. The P/E ratio is also much higher than I look for at a lofty 21.56. That low dividend yield is backed by a recent hike of the dividend by 47%. They have grown their dividend for as long as they've been publicly traded, which has been three years. They've doubled their dividend in that time frame. This would probably be a smaller position for me, if I were to initiate a position.

What about you? Looking at any low yield, high growth opportunities?

Thanks for reading.

This article was written by Dividend Mantra. If you enjoyed this article, please consider subscribing to my feed.

Continue Reading »

Urbana Management Responds

A few days ago, a group of value investors (which included the authors of sites frankvoisin.com and pettycash.wordpress.com) sent a letter to Urbana's chief executive asking that the company be more aggressive in its share buybacks. Frequent visitors to this site may recall that Urbana has been discussed here as a potential value investment due to the rather large discount at which it trades to its (mostly stock) portfolio. Management's response was rather predictable.

Continue Reading »

BP's High Dividend Yield

Oil companies have not been in the news recently since oil prices have been declining. Oil has spent a large amount of the summer and fall trading in the $80 range and below. This has caused a lot of investors to abandon the sector. That is a big mistake because there are some great dividend plays in the oil and gas sector. Here is one of the stocks that is offering up a nice yield.

BP (BP) has not been an investor favorite since the big oil spill that took place a few years ago. The company booked billions in losses paying off claims and cleaning up the ocean where the spill took place. BP eliminated its dividend which had been one of the best in the entire sector. The bad times appear to be behind BP and the company’s future is looking bright.

BP’s net income tripled this past quarter with the company booking a $4.9 billion dollar profit. That is a pretty solid number considering the fact that the company had to curtail its drilling after the disaster in the Gulf of Mexico. The Gulf was one of the primary drilling areas for BP and the company is finally going to start ratcheting up production again. The company’s output should return to pre-spill levels.

The CEO of BP is bullish on the company as well stating that BP has reached a turning point and believes that the best earnings numbers are ahead of the company. Investors have reason to smile as well since BP has reinstated its dividend and the stock is a serious high yielder.

BP pays a dividend of $1.68 per share which is just a 13% payout of earnings. The company is loaded with more than $20 billion dollars in cash on its balance sheet and generates nearly $9.5 billion dollars in operating cash flow. Shares are currently trading at just 1.2 times book value and the stock is yielding 4%. That is a solid yield and the dividend should only increase as operations continue to go back to normal at BP.

This article was written by [Buy Like Buffett]. If you enjoyed this article, please consider subscribing to my feed at [RSS].

Continue Reading »

Stock Analysis: Coca-Cola Company (KO)

Company Description: The Coca-Cola Company is the world's largest soft drink company, and it also has a sizable fruit juice business.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description:

1. Avg. High Yield Price

2. 20-Year DCF Price

3. Avg. P/E Price

4. Graham Number

KO is trading at a discount to only 3.) above. The stock is trading at a slight premium to its calculated fair value of $64.83. KO did not earn any Stars in this section.

Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description:

1. Free Cash Flow Payout

2. Debt To Total Capital

3. Key Metrics

4. Dividend Growth Rate

5. Years of Div. Growth

6. Rolling 4-yr Div. > 15%

KO earned two Stars in this section for 2.) and 3.) above. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%. KO earned a Star for having an acceptable score in at least two of the four Key Metrics measured. The company has paid a cash dividend to shareholders every year since 1893 and has increased its dividend payments for 49 consecutive years.

Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description:

1. NPV MMA Diff.

2. Years to > MMA

KO earned a Star in this section for its NPV MMA Diff. of the $557. This amount is in excess of the $500 target I look for in a stock that has increased dividends as long as KO has. If KO grows its dividend at 6.8% per year, it will take 4 years to equal a MMA yielding an estimated 20-year average rate of 3.6%. KO earned a check for the Key Metric 'Years to >MMA' since its 4 years is less than the 5 year target.

Memberships and Peers: KO is a member of the S&P 500, a Dividend Aristocrat and a member of the Broad Dividend Achievers™ Index and a Dividend Champion. The company's peer group includes: Dr. Pepper Snapple Group (DPS) with a 3.5% yield, Pepsico, Inc (PEP) with a 3.4% yield and Fomento Economico ADR (FMX) with a 1.8% yield .

Conclusion: KO did not earn any Stars in the Fair Value section, earned two Stars in the Dividend Analytical Data section and earned one Star in the Dividend Income vs. MMA section for a total of three Stars. This quantitatively ranks KO as a 3 Star-Hold stock.

Using my D4L-PreScreen.xls model, I determined the share price would need to increase to $67.92 before KO's NPV MMA Differential decreased to the $500 minimum that I look for in a stock with 49 years of consecutive dividend increases. At that price the stock would yield 2.8%.

Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $500 NPV MMA Differential, the calculated rate is 6.5%. This dividend growth rate is slightly lower than the 6.5% used in this analysis, thus providing a slight margin of safety. KO has a risk rating of 1.25 which classifies it as a Low risk stock.

Coca-Cola is one of the most recognizable names in the world. KO is able to deliver products to nearly all points on the globe through an extensive direct distribution network that has few peers. Its world presence will be relied on to compensated for declining consumption of carbonated beverages in the North American market. The company's pristine balance sheet and strong free cash flow makes this a desirable stock when it is trading below my fair value price of $64.83.

Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information.

Full Disclosure: At the time of this writing, I was long in KO (2.6% of my Dividend Growth Portfolio). See a list of all my dividend growth holdings here.

Related Articles:

- Medtronic Inc. (MDT) Dividend Stock Analysis

- Walgreen Co. (WAG) Dividend Stock Analysis

- T. Rowe Price Group Inc. (TROW) Dividend Stock Analysis

- Pepsico, Inc. (PEP) Dividend Stock Analysis

- More Stock Analysis

This article was written by Dividends4Life. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Weekend Reading Links - October 23, 2011

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Articles From DIV-Net Members

There are some really good articles here, please take time and read a few of them.

Continue Reading »

Weekend Reading Links - October 22, 2011

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Articles From DIV-Net Members

There are some really good articles here, please take time and read a few of them.

Continue Reading »

Roth IRAs

Nothing is certain in this world except for death and taxes. For many dividend growth investors, this could be characterized as a feeling that they are being taxed to death. While I keep most of my assets in taxable brokerage accounts, I am always on the lookout to legally minimize my investment taxes as much as possible. In fact there is a way to invest in dividend paying stocks without ever having to pay taxes on your investment. "In fact there is a way to invest in dividend paying stocks without ever having to pay taxes on your investment."

The Roth IRA allows individuals who have earned income in a given year to contribute up to $5000 in after-tax dollars to their retirement account. There is a catch-up contribution of $1000 for individuals who are 50 years of age or older. While contributions to Roth IRA’s are not deductible on your tax returns, earnings and principal distributions are tax free once certain age and time requirements are met. Roth IRA’s allow for tax-free compounding of capital over time.

The earned income includes compensation from salary, wages, commissions, bonuses and alimony. Income from interest, dividends, annuities or pensions does not count as earned income in the eyes of the IRS.

The contribution limit for a Roth IRA is the same as the contribution limit for a regular IRA. However the amount that can be contributed to a Roth IRA is the amount remaining after subtracting any contribution made to a regular IRA. This means that if you contributed the maximum allowable amount to your regular IRA of $5000, you would not be able to contribute anything to a Roth IRA in that year.

There are no required minimum distribution rules for Roth IRAs. However, there are phase-out income limits for high earning taxpayers, which reduce the opportunity to use this tax advantaged investment account.

In order to avoid paying taxes on distributions from Roth IRA accounts, investors need to become acquainted with the qualified nontaxable distribution rules.

According to the IRS, qualified nontaxable distributions for Roth IRA’s are those made at least 5 years after the taxpayer’s first contribution to a Roth IRA and made:

1) After the taxpayer become 59.5 years old

2) To a beneficiary after the death of the taxpayer

3) Because the taxpayer becomes disabled

4) For a use of a first time homebuyer

The biggest benefits of a Roth IRA are the long-term tax free compounding of capital, the fact that qualified distributions are tax-free and the fact that there are no required minimum distributions. Another little known fact behind Roth IRA’s is that direct contributions may be withdrawn at any time. This makes them a perfect investment vehicle for investors who plan on retiring early and living off dividends before they reach typical retirement ages of 60 years.

I hold several stocks in Roth IRA accounts. Given the fact that the limit is $5000/year and that I typically purchase stocks in $1000 increments, I do not own a whole lot of different companies in my ROTH. The five companies I plan to add to my Roth IRA in 2011 include:

Philip Morris International Inc. (PM), through its subsidiaries, manufactures and sells cigarettes and other tobacco products. Yield: 4.60% (analysis)

Johnson & Johnson (JNJ) engages in the research and development, manufacture, and sale of various products in the health care field worldwide. Yield: 3.50% (analysis)

The Procter & Gamble Company (PG) provides consumer packaged goods in the United States and internationally. Yield: 3.40% (analysis)

PepsiCo, Inc. (PEP) engages in the manufacture, marketing, and sale of foods, snacks, and carbonated and non-carbonated beverages worldwide. Yield: 3.20% (analysis)

Kinder Morgan, Inc.(KMI) owns and operates energy infrastructure in the United States and Canada. The company operates in six segments: Products Pipelines-KMP, Natural Gas Pipelines—KMP, CO2—KMP, Terminals—KMP, Kinder Morgan Canada—KMP, and NGPL PipeCo LLC. Yield: 4.50% (analysis)

- Philip Morris International (PM) Dividend Stock Analysis

Continue Reading »

Intel Rises 3.59% On Strong Third-Quarter Profit

Intel (INTC) rose 3.59% today on strong third-quarter profit. Intel is the largest chipmaker in the world. Intel develops and manufactures microprocessors and and platform solutions for the global personal computer and server market.

Intel earned $0.65 per share over the third-quarter, which exceeded analyst estimates of $0.61 per share. It had third-quarter revenue of $14.2 billion, which also exceeded analyst estimates of $13.9 billion. The future bodes well for Intel. You can clearly see a rising trend with both earnings and revenue.

Although there are some headwinds for Intel, which includes the lack of penetration into the mobile and tablet markets, I feel that their dominance in the microprocessor market and unrivaled R&D places them as one of the top companies in tech. I'm not a huge fan of tech companies in general, as some of the products they make are quite honestly a little beyond me. It's somewhat easy to see and understand what exactly Intel does. They make a product that is needed by billions of people, and the need for servers isn't going anywhere. All the smartphones and tablets around us need servers to communicate with and pass along information. That's where Intel, smartly, becomes the middleman.

I purchased Intel earlier this summer and thought about adding to my position around $20. I wish I would have, but at the time I found other opportunities. So many equities, so little cash. The dividend growth has been particularly strong with INTC. They have raised their dividend twice in 2011. They first raised it in February from $0.16 per share to $0.18 per share. They again raised it in August to $0.21 per share. They are quickly turning into a formidable dividend growth stock.

I have had INTC on my watch list for additions on a pullback, but it looks like I may have missed my opportunity for now. I would like to add to my position if it pulls back to the $22 level.

Full Disclosure: I'm long INTC.

Thanks for reading.

This article was written by Dividend Mantra. If you enjoyed this article, please consider subscribing to my feed.

Continue Reading »

Shorting The Green

I don't short stocks, but every once in a while I am tempted to do so. For those of you value investors who do short, you may want to consider Green Mountain Coffee Roasters (GMCR) as a potential candidate. In a recent presentation, David Einhorn discusses some of the features that make this a great short candidate: a high price, a lack of free cash flow, some serious accounting questions, frequent capital raises (despite accounting profitability), and some interviews of former employees suggesting a lack of transparency. The slides can be found here.

Disclosure: No position

Continue Reading »

Stock Analysis: Genuine Parts Company (GPC)

Company Description: Genuine Parts Co is a leading wholesale distributor of automotive replacement parts, industrial parts and supplies, and office products.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description:

1. Avg. High Yield Price

2. 20-Year DCF Price

3. Avg. P/E Price

4. Graham Number

GPC is trading at a premium to all four valuations above. The stock is trading at a 11.6% premium to its calculated fair value of $45.54. GPC did not earn any Stars in this section.

Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description:

1. Free Cash Flow Payout

2. Debt To Total Capital

3. Key Metrics

4. Dividend Growth Rate

5. Years of Div. Growth

6. Rolling 4-yr Div. > 15%

GPC earned three Stars in this section for 1.), 2.) and 3.) above. A Star was earned since the Free Cash Flow payout ratio was less than 60% and there were no negative Free Cash Flows over the last 10 years. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%.

The company earned a Star for having an acceptable score in at least two of the four Key Metrics measured. It has paid a cash dividend to shareholders every year since 1948 and has increased its dividend payments for 55 consecutive years.

Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description:

1. NPV MMA Diff.

2. Years to > MMA

The NPV MMA Diff. of the $418 is below the $500 target I look for in a stock that has increased dividends as long as GPC has. If GPC grows its dividend at 4.8% per year, it will take 4 years to equal a MMA yielding an estimated 20-year average rate of 4.1%. GPC earned a check for the Key Metric 'Years to >MMA' since its 4 years is less than the 5 year target.

Memberships and Peers: GPC is a member of the S&P 500 and a member of the Broad Dividend Achievers™ Index and a Dividend Champion. The company's peer group includes: Advance Auto Parts Inc. (AAP) with a 0.4% yield, AutoZone Inc. (AZO) with a 0.0% yield and W.W. Grainger, Inc. (GWW) with a 1.8% yield.

Conclusion: GPC did not earn any Stars in the Fair Value section, earned three Stars in the Dividend Analytical Data section and did not earn any Stars in the Dividend Income vs. MMA section for a total of three Stars. This quantitatively ranks GPC as a 3 Star-Hold stock.

Using my D4L-PreScreen.xls model, I determined the share price would need to decrease to $48.70 before GPC's NPV MMA Differential increased to the $500 minimum that I look for in a stock with 55 years of consecutive dividend increases. At that price the stock would yield 3.7%.

Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $500 NPV MMA Differential, the calculated rate is 5.2%. This dividend growth rate is slightly higher than the 4.8% used in this analysis, thus providing no margin of safety. GPC has a risk rating of 1.25 which classifies it as a Low risk stock.

GPC’s long string of dividend increases are supported by its strong underlying fundamentals of sales, earnings and free cash flow growth. The company exhibits excellent financial leadership as evidenced perseverance through the recent downturn. From an operating standpoint, GPC has an extensive distribution network and it has built a loyal customer following over the years.

Since the company is has proven itself in the most recent downturn, it now trades at a premium to my $45.54. However, given its strong dividend fundamentals, I will look for opportunities to add to my position.

Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information.

Full Disclosure: At the time of this writing, I was long in GPC (4.5% of my Dividend Growth Portfolio). See a list of all my dividend growth holdings here.

Related Articles:

- Walgreen Co. (WAG) Dividend Stock Analysis

- T. Rowe Price Group Inc. (TROW) Dividend Stock Analysis

- Pepsico, Inc. (PEP) Dividend Stock Analysis

- General Dynamics (GD) Dividend Stock Analysis

- More Stock Analysis

This article was written by Dividends4Life. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

ADM Stock Analysis

Archer-Daniels-Midland Company (ADM) procures, transports, stores, processes, and merchandises agricultural commodities and products in the United States and internationally. Archer-Daniels-Midland is a dividend aristocrat, which has paid uninterrupted dividends on its common stock since 1927 and increased payments to common shareholders every year for 36 years.

The most recent dividend increase was in February 2011, when the Board of Directors approved a 6.70% increase in the quarterly dividend to 16 cents/share. Archer Daniels Midland ’s largest competitors include Bunge (BG), Corn Products Intl (CPO) and Griffin Land and Nurseries (GRIF).

Over the past decade this dividend growth stock has delivered an annualized total return of 8.80% to its shareholders.

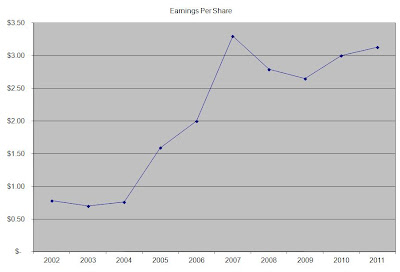

The company has managed to deliver a 16.70% annual increase in EPS since 2002. Analysts expect Archer-Daniels-Midland to earn $3.07 per share in 2012 and $3.40 per share in 2013. In comparison Archer-Daniels-Midland earned $3.13 /share in 2011.

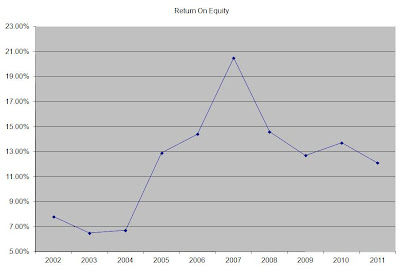

The company’s Returns on Equty has been quite volatile, and closely followed the volatility in EPS. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

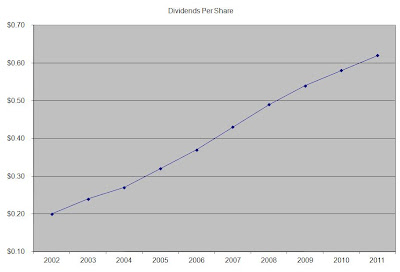

The annual dividend payment has increased by 13.30% per year over the past decade, which is lower than the growth in EPS.

A 13% growth in distributions translates into the dividend payment doubling every five and a half years. If we look at historical data, going as far back as 1990 we see that Archer-Daniels-Midland has managed to double its dividend almost every 5 years on average.

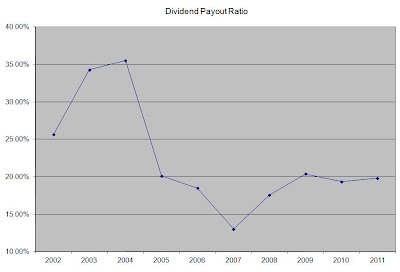

The dividend payout ratio has been on the decline since 2002. Lately it has stabilized around 20%, which is very conservative. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently Archer-Daniels-Midland is attractively valued and is trading at 8.10 times earnings, yields 2.50% and has a sustainable forward dividend payout. I would add to my position subject to availability of funds on dips below $25.60/share.

Full Disclosure: Long ADM

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Two Industrials Catching My Eye

I'm a huge believer in investing in dividend growth stocks. In fact, I'm such a huge believer that I'm going to be investing the majority of my net income into such stocks every single month for the next 11 years. If I wasn't confident that this was a great way to build growing wealth I wouldn't be betting a significant part of my life on this strategy.

With all that being said, however, it must be noted that investing in the right companies at the right time is critical. I have over 50 stocks on my watch list at any given time, and although I consider all of them worthwhile investments...they aren't all worthwhile at the same exact time. Some companies are trading for more attractive valuations than others for many different reasons. There are microeconomics, macroeconomics, and individual company concerns that could be inflating or deflating a stock's price relative to the overall market. It seems that a number of the large blue chip companies like Procter & Gamble, Johnson & Johnson and Coca-Cola are trading for fairly lofty values and although I'm long all three I am not adding to my positions at this time.

I have been interested in a few companies in the industrial sector. It seems there are a lot of depressed stocks in this sector due to the economy slowdown as well as proposed U.S. defense budget cuts. Here are two that are currently catching my eye:

Raytheon Company (RTN)

Per Morningstar:

Raytheon is a major United States defense contractor with nearly $25 billion in annual sales that operates through six segments: integrated defense systems, intelligence and information, missile systems, network-centric systems, space and airborne systems, and technical services. Sales to the U.S. government account for more than 88% of the company's total sales. Waltham, Mass., based Raytheon employs 72,000 people.

RTN is trading for a current P/E ratio of 7.95, which is well under the industry average. They have an attractive entry yield of 4.04% at current prices with strong dividend growth to boot. They have been growing dividends for seven years, with a 5-year dividend growth rate of 10.8%. They have a pretty low payout ratio of 32% and a pretty strong balance sheet. Their debt/equity ratio is currently at 0.4. I think the proposed slowdown in U.S. defense spending could negatively impact Raytheon's bottom line, I don't believe the military is going to reduce its spending significantly, and although it's a popular budget to attack in the public, defense is as necessary as ever in these turbulent times. I believe in this company long-term. I think it's trading at an attractive valuation relative to the market and has been punished by going -8% YTD with some of the proposed budget cuts already priced in, in my opinion.

General Dynamics Corporation (GD)

Per Morningstar:

Falls Church, Va.-based General Dynamics manufactures ships, armored vehicles, defense-oriented information technology systems, and business jets. The firm gets around 72% of revenue from the Department of Defense and the rest from foreign sales and Gulfstream business jets. In 2010, the firm generated $32.4 billion in sales and $2.6 billion in earnings.

General Dynamics is currently trading for a P/E ratio of 8.87 and has an attractive entry yield of 3.01%. The 20-year dividend growth streak is highly likely to keep going for many years into the future. It has a 5-year dividend growth rate of 16%, which is pretty strong. The debt/equity ratio is 0.2. The low payout ratio of 27% encourages many more years of dividend growth. This equity falls into the same boat as RTN, as its revenues depend largely on the U.S. DOD, with 72% of revenues coming from that one location. The nice thing with GD is that they do have some diversification into the commercial sector selling their Gulfstream business jets. I think, as the same with RTN, that budget cuts are priced into this stock. They have suffered in 2011, going -11.89% YTD. This one is pretty high up on my watch list for a potential addition into my Freedom Fund.

Full Disclosure: No positions.

Thanks for reading.

This article was written by Dividend Mantra. If you enjoyed this article, please consider subscribing to my feed.

Continue Reading »

Gaming Partners Cashes In

Value investors love companies with lots of cash. At the very least, a net cash position protects a company from going under when times are tough. And during good times, the cash can be doled out to shareholders. But whether a cash distribution (or buyback) will actually occur is worthy of investigation before the investor actually takes a position, for many companies have no interest in actually returning cash to shareholders.

Consider Gaming Partners International (GPIC), a manufacturer and distributor of gaming chips and other casino-related supplies.

Continue Reading »

Kimberly Clark's Dividend Yield

Consumer staples are always a good place to look for investor seeking stable earnings. Consumer staple stocks offer slow growth and sell products that people will buy during good and bad economic times. The earnings stability often makes consumer staple stocks a good dividend play because of the large amounts of cash that they generate. Some of the best dividend payers in the market come from this sector.

Kimberly Clark Corporation (KMB) makes a number of different consumer health and hygiene products. The company manufactures personal care, paper, and tissue products. The consumer staples firm has a portfolio of popular products including Huggies, Kleenex, and Scott. Kimberly Clark competes against heavyweights Proctor & Gamble and Johnson & Johnson. The company has been around since 1872 and has grown to a market cap of $28 billion dollars.

Kimberly Clark is in solid financial shape. The company generates a substantial amount of free cash flow earning $1.7 billion dollars last year and $2.6 billion the previous year. The firm has over $1 billion in cash on the balance sheet and $7 billion in debt. Kimberly Clark is a slow growth company with revenue and earnings growing just under 3% over the past few years. Operating margins are below the industry average coming in at 12.6% for the current year.

The stock trades at 17 times this year’s earnings and 13.7 times next year’s earnings. The stock trades at 5 times book value and 1.4 times sales. Kimberly Clark is attractive to investors because of its long term dividend history. The company increased its dividend 10 percent in February of this year marking the 39th consecutive year that shareholders have seen a dividend increase.

Kimberly Clark pays a dividend of $2.80 per share which comes out to a dividend yield of 3.9%. That places the company in high yield territory. The current payout rate is 64% of earnings which is high but sustainable. The stock is not trading at a bargain level but the dividend yield makes Kimberly Clark an attractive stock to income seekers.

This article was written by [Buy Like Buffett]. If you enjoyed this article, please consider subscribing to my feed at [RSS].

Continue Reading »

Stock Analysis: Nucor Corporation (NUE)

Company Description: Nucor Corporation is the largest minimill steelmaker in the U.S., and has one of the most diverse product lines of any steelmaker in the Americas.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description:

1. Avg. High Yield Price

2. 20-Year DCF Price

3. Avg. P/E Price

4. Graham Number

NUE is trading at a discount to 1.), 2.) and 3.) above. The stock is trading at a 38.9% discount to its calculated fair value of $51.68. NUE earned a Star in this section since it is trading at a fair value.

Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description:

1. Free Cash Flow Payout

2. Debt To Total Capital

3. Key Metrics

4. Dividend Growth Rate

5. Years of Div. Growth

6. Rolling 4-yr Div. > 15%

NUE earned three Stars in this section for 1.), 2.) and 3.) above. A Star was earned since the Free Cash Flow payout ratio was less than 60% and there were no negative Free Cash Flows over the last 10 years. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%. NUE earned a Star for having an acceptable score in at least two of the four Key Metrics measured.

Rolling 4-yr Div. > 15% means that dividends grew on average in excess of 15% for each consecutive 4 year period over the last 10 years (2001-2004, 2002-2005, 2003-2006, etc.) I consider this a key metric since dividends will double every 5 years if they grow by 15%. The company has paid a cash dividend to shareholders every year since 1973 and has increased its dividend payments for 38 consecutive years.

Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description:

1. NPV MMA Diff.

2. Years to > MMA

NUE earned a Star in this section for its NPV MMA Diff. of the $26,119. This amount is in excess of the $500 target I look for in a stock that has increased dividends as long as NUE has. The stock's current yield of 4.6% exceeds the 4.1% estimated 20-year average MMA rate.

Memberships and Peers: NUE is a member of the S&P 500 and a member of the Broad Dividend Achievers™ Index and a Dividend Champion. The company's peer group includes: Commercial Metals Company (CMC) with a 4.6% yield, Steel Dynamics Inc. (STLD) with a 3.6% yield and United States Steel Corp. (X) with a 0.8% yield.

Conclusion: NUE earned one Star in the Fair Value section, earned three Stars in the Dividend Analytical Data section and earned one Star in the Dividend Income vs. MMA section for a total of five Stars. This quantitatively ranks NUE as a 5 Star-Very Strong stock.

Using my D4L-PreScreen.xls model, I determined the share price would need to increase to $115.42 before NUE's NPV MMA Differential decreased to the $500 minimum that I look for in a stock with 38 years of consecutive dividend increases. At that price the stock would yield 1.3%.

Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $500 NPV MMA Differential, the calculated rate is 2.5%. This dividend growth rate is well below the 15.0% used in this analysis, thus providing a margin of safety. NUE has a risk rating of 1.50 which classifies it as a Low risk stock.

Like many cyclical industrials, NUE’s earnings and cash flow have struggled over the last two years. However, the company is well managed with a solid share in its markets, a very low ratio of total debt to capital percentage and a very diverse product mix. The company’s pay-for-performance and low-cost operations have helped mitigate weak demand in the most recent downturn.

Over the past quarter, the company has seen improvement in it dividend fundamentals. So much so, I may purchase some additional shares prior to its next dividend announcement when I expect to see a small increase in its rate. NUE's calculated fair value price is $51.68. However, that price uses a 15% dividend growth rate, which I think is too high for the next several years. Using a more reasonable 3% growth rate, NUE is trading at a discount to it NPV MMA Price of $33.09.

Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information.

Full Disclosure: At the time of this writing, I was long in NUE (1.2% of my Dividend Growth Portfolio). See a list of all my dividend growth holdings here.

Related Articles:

- Pepsico, Inc. (PEP) Dividend Stock Analysis

- General Dynamics (GD) Dividend Stock Analysis

- Owens & Minor, Inc. (OMI) Dividend Stock Analysis

- Diebold, Inc. (DBD) Dividend Stock Analysis

- More Stock Analysis

This article was written by Dividends4Life. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Weekend Reading Links - October 9, 2011

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Articles From DIV-Net Members

There are some really good articles here, please take time and read a few of them.

Continue Reading »

RPM International Stock Analysis

RPM International Inc. (RPM), together with its subsidiaries, manufactures, markets, and sells various specialty chemical products to industrial and consumer markets worldwide. RPM International is a dividend champion which has paid uninterrupted dividends on its common stock since 1969 and increased payments to common shareholders every year for 37 years.

The most recent dividend increase was in October 2010, when the Board of Directors approved a 2.40% increase in the quarterly dividend to 21 cents/share. RPM International ’s largest competitors include Valspar (VAL), PPG Industries (PPG) and Sherwin-Williams (SHW).

Over the past decade this dividend growth stock has delivered an annualized total return of 11.60% to its shareholders.

The company has managed to deliver a 4.60% annual increase in EPS since 2001. Analysts expect RPM International to earn $1.60 per share in 2012 and $1.77 per share in 2013. In comparison RPM International earned $1.46 /share in 2011.

The company’s Returns on Equty has been quite volatile, and closely followed the volatility in EPS. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

The annual dividend payment has increased by 6% per year over the past decade, which is higher than the growth in EPS. Dividend increases have been largely symbolic over the past three years however.

A 6% growth in distributions translates into the dividend payment doubling every twelve years. If we look at historical data, going as far back as 1996, we see that RPM International has actually managed to double its dividend every 15 years on average.

The dividend payout ratio has remained below 50% in only 3 of the past ten years, and has closely tracked the volatility in earnings. Based on forward earnings for 2011 however, the payout ratio is close to 50%. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently RPM International is trading at 13.20 times earnings, yields 4.40% and has a sustainable forward dividend payout. The erratic earnings picture over the past decade however makes this stock a hold.

Full Disclosure: Long RPM

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »

Consumer Stocks: Safety In A Volatile Market

As an investor, my primary objective is to preserve capital and then grow it. One of the best ways to preserve capital is to invest in defensive stocks that have less overall volatility than the general markets. These stocks usually aren't your fast growth stocks with huge catalysts behind them, but offer a sense of safety and stability...especially when there is so much uncertainty around us.

Today I want to present two consumer dividend growth stocks that have shown a lot of safety and have far outperformed the overall market.

The Coca-Cola Company (KO)

Coca-Cola is the world's largest manufacturer, distributor, and marketer of nonalcoholic beverage concentrates and syrups. The firm also sells a variety of noncarbonated drinks such as water, juices, and teas. With almost three fourths of the company's revenue generated outside the United States, Coke's footprint extends throughout the world. Coke's core brands include Coca-Cola, Sprite, Dasani, Powerade, and Minute Maid.

This stock is currently yielding 2.87%, which offers current income while you wait out the rise in the markets. That yield comes with 49 straight years of dividend growth as well. Coca-Cola offers an investor the strength and safety of one of the world's best known brands. This is a great business and Mr. Market seems to have priced that in. The S&P is down just over 9% on the year, while KO is only down 0.36%. This stock has far outperformed the S&P 500. This company offers great preservation of capital. As Warren Buffet said: "Rule No. 1: Don't lose money. Rule No. 2: Don't forget rule no. 1.". It has a debt/equity ratio of 0.3.

McDonald's Corporation (MCD)

McDonald's generates revenue through company-owned restaurants, franchise royalties, and licensing pacts. Restaurants offer a uniform value-priced menu, with some regional variations. As of March 2011, there were 32,800 locations in 117 countries, including 26,400 operated by franchisees/affiliates and 6,400 company units.

This stock is currently yielding 3.26%, which is actually quite solid for such a safe large-cap company. This kind of yield offers a floor for the stock's price. This business is absolute solid. When you invest with McDonald's you're getting a piece of the profits from one of the best known brands in the world. It has a fair amount of debt with a debt/equity ratio of 0.7, but this is actually much lower than a lot of other companies in its industry. It has 35 years of dividend growth behind it, and there is no reason to believe this is going to abate anytime soon. MCD has risen 11.8% YTD, vs. the S&P 500 at a 9% loss for the year. This stock has greatly outperformed the market.

Full Disclosure: I'm long KO and MCD.

Thanks for reading.

This article was written by Dividend Mantra. If you enjoyed this article, please consider subscribing to my feed.

Continue Reading »

Short Memories And Temporary Conditions

While there are many who believe market prices accurately reflect all available information, value investors believe there are many instances where market prices can be way out of line with reality. In our society, financial memory appears to be extremely short, causing speculators to fall prey to the same situations over and over. Recent happenings in the rare earths market illustrate this phenomenon very well.

Continue Reading »

Brookfield Office Properties High Yield

Today’s stock is a real estate company that has a really high yield. The company is very active in the commercial real estate industry owning lots of properties in high rent markets like New York, Boston, and Washington D.C. The commercial real estate company was founded in 1923 and has more than $20 billion dollars in assets. The firm recently added to its holding acquiring GMAC Real Estate in 2008. The company in question is Brookfield Office Properties (BPO).

Brookfield Office Properties is one of those high yielding real estate companies out there. The stock is currently selling at its 52 week low of $13 per share. As with most real estate companies, Brookfield Office trades at a value that is significantly higher than its current earnings growth. Shares are trading at 13 times the current year’s earnings and 13 times next year’s earnings. That is much higher than the sub 3% growth expected next year. Shares are not expensive at a price to book ratio of 0.8.

Brookfield has been largely attractive to investors because of the amount of free cash flow that the company generates. Last year the company generated $192 million in cash flow from operations and $19 million dollars in free cash flow. The company’s free cash flow dipped substantially over the first half of the year. Free cash flow was down $24 million dollars from operations and free cash flow was down $222 million dollars due to capital expenditures.

The company is currently yielding 4.1% on a dividend of 57 cents per share. Brookfield Office is paying out less than 50% of this year’s earnings estimates so there is room for a dividend increase. Brookfield has been relatively stable having paid a dividend for 15 consecutive years.

Investors should keep in mind that the company does face uncertainty as the company has more than $8 billion dollars in long term debt. The company relies heavily on access to credit to restructure its debt and could be vulnerable to a credit crunch if the economy enters another recession.

This article was written by [Buy Like Buffett]. If you enjoyed this article, please consider subscribing to my feed at [RSS].

Continue Reading »

Stock Analysis: Johnson & Johnson (JNJ)

Company Description: Johnson & Johnson is a leader in the pharmaceutical, medical device and consumer products industries.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description:

1. Avg. High Yield Price

2. 20-Year DCF Price

3. Avg. P/E Price

4. Graham Number

JNJ is trading at a discount to only 1.) above. The stock is trading at a 5.6% premium to its calculated fair value of $61.14. JNJ did not earn any Stars in this section.

Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description:

1. Free Cash Flow Payout

2. Debt To Total Capital

3. Key Metrics

4. Dividend Growth Rate

5. Years of Div. Growth

6. Rolling 4-yr Div. > 15%

JNJ earned three Stars in this section for 1.), 2.) and 3.) above. A Star was earned since the Free Cash Flow payout ratio was less than 60% and there were no negative Free Cash Flows over the last 10 years. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%.

The company earned a Star for having an acceptable score in at least two of the four Key Metrics measured. The company has paid a cash dividend to shareholders every year since 1944 and has increased its dividend payments for 49 consecutive years.

Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description:

1. NPV MMA Diff.

2. Years to > MMA

JNJ earned a Star in this section for its NPV MMA Diff. of the $783. This amount is in excess of the $500 target I look for in a stock that has increased dividends as long as the company has. If JNJ grows its dividend at 6.6% per year, it will take 3 years to equal a MMA yielding an estimated 20-year average rate of 4.1%. JNJ earned a check for the Key Metric 'Years to >MMA' since its 3 years is less than the 5 year target.

Memberships and Peers: JNJ is a member of the S&P 500, a Dividend Aristocrat and a member of the Broad Dividend Achievers™ Index and a Dividend Champion. The company's peer group includes: The Abbott Laboratories (ABT) with a 3.8% yield, Eli Lilly & Co. (LLY) with a 5.3% yield and Bristol-Myers Squibb Company (BMY) with a 4.5% yield.

Conclusion: JNJ did not earn any Stars in the Fair Value section, earned three Stars in the Dividend Analytical Data section and earned one Star in the Dividend Income vs. MMA section for a total of four Stars. This quantitatively ranks JNJ as a 4 Star-Strong stock.

Using my D4L-PreScreen.xls model, I determined the share price would need to increase to $73.01 before JNJ's NPV MMA Differential decreased to the $500 minimum that I look for in a stock with 49 years of consecutive dividend increases. At that price the stock would yield 3.1%.

Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $500 NPV MMA Differential, the calculated rate is 5.4%. This dividend growth rate is below the 6.6% used in this analysis, thus providing a margin of safety. JNJ has a risk rating of 1.00 which classifies it as a Low risk stock.

The company enjoys a diverse revenue base, an excellent research pipeline, a pristine balance sheet and exceptional free cash-flows to cover its dividend. This diversity and strength will help the company overcome near-term results from patent losses on Risperdal and Topamax. JNJ's pharma segment should benefit from a number of key new product launches (Edurant, Xarelto and Zytiga). I will continue to add to my position as my allocation allows and when JNJ is trading near or below my calculated fair value price of $61.14.

Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information.

Full Disclosure: At the time of this writing, I was long in JNJ (4.5% of my Dividend Growth Portfolio) and long in ABT. See a list of all my dividend growth holdings here.

Related Articles:

- Owens & Minor, Inc. (OMI) Dividend Stock Analysis

- Diebold, Inc. (DBD) Dividend Stock Analysis

- Lowe's Companies, Inc. (LOW) Dividend Stock Analysis

- United Technologies Corp. (UTX) Dividend Stock Analysis

- More Stock Analysis

This article was written by Dividends4Life. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Continue Reading »