Great-West LifeCo (TSE:GWO) started as an insurance company and like many of its competitors, it has turned itself into a financial company operating in many of the financial sectors:

- Life Insurance

- Health Insurance

- Asset Management

- Investment and Retirement Savings

- Reinsurance Business

- The Great-West Life Assurance Company

- London Life Company

- The Canada Life Assurance Company

- Great-West Life & Annuity Insurance Company

- Putnam Investment, LLC

Quick Facts

- Stock Ticker: GWO on TSX

- Market Cap.: 24.01B$

- P/E: 14.50

- Forward P/E: 10.40

- EPS: $1.75

- Beta: 0.92

- Quarterly Dividends: $0.31

- Dividend Yield: 4.90%

- Dividend Payout Ratio: 70.29%

- ROE: 14.26%

- 5 Year EPS Growth Average: 0.67%

- 5 Year Dividend Growth Average: 8.90%

- 52-Week Low: $23.37

- 52-Week High: $29.24

- 52-Week Range: 33.22%

Dividend Growth

Just like its parent company, Great-West LifeCo was removed from the Canadian Dividend Aristocrats list this past December for failing to increase its dividends. It follows the pattern of most financial institutions in Canada due to the financial crisis of late 2008. Up until 2009, GWO had at least 13 years of dividend growth. As you can see, historical growth was consistent and above inflation with a 5 year average of 8.9% growth including the recent flat years.

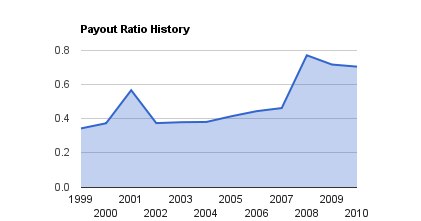

Dividend Payout Ratio

I like what I see before 2008. The ratio was relatively consistent and within a good range that still allow the company to grow. A 40%-60% average is in line with most financial companies as well. The question is when are they expected to make it back to those level. If the forward P/E is any indicator, it looks promising for a return to normal level in the coming years.

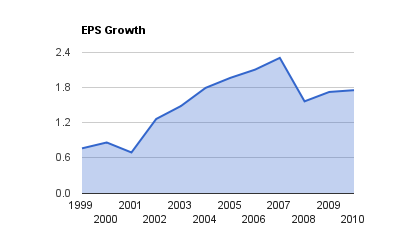

EPS Growth

Same story as the payout ratio. I like what I see before 2008 and I like that the drop was only for 1 year with signs of growth, albeit slow, for the following years.

Thoughts

When looking at a few of technical points such as price within 52 week range, Forward P/E and Beta, the company appears to show future potential as an investment with growth. It may be price for an entry point with the recent drop. Its return on equity is attractive while providing a good dividend. One key question is do you go for its parent company, Power Financial, or even the parent company of the parent, Power Corporation?Readers: Is Great-West LifeCo attractive at this price and yield?

Full Disclosure: At the time of writing I hold no position.

Disclaimer: The material presented should not be considered a recommendation. You should always do your own research and reach your own conclusion. This article was written by The Passive Income Earner. If you enjoyed this article, please consider subscribing to my feed.