What Makes Mondelez (MDLZ) a Good Business?

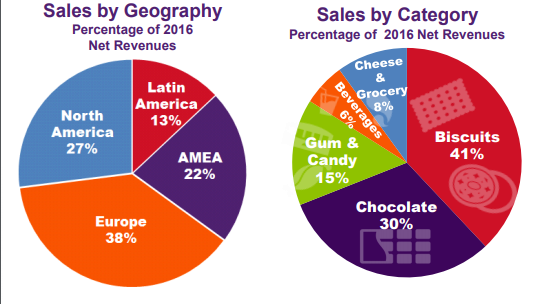

When I think of Mondelez, I think… yummy! I must admit I’m a bit biased; Oreo Cookie & Cream are my favorite cookies. Besides making delicious cookies, Mondelez is one of the world’s largest snack manufacturer. The company is mostly known for its cookies and chocolate brands representing 71% of its revenue.

Source: MDLZ fact sheet

The company is driving 70% of what they call their “power brand” as follows:

Source: MDLZ fact sheet

Revenue

Revenue Graph from Ycharts

Over the years, MDLZ has grown to a point beyond reason. In fact, Mondelez is the result of a separation of Kraft (formerly KFT) and what became Mondelez after the spin-off in 2012. Since then, Kraft has been bought by Warren Buffett and merged with Heinz to create Kraft Heinz (KHC). Are you lost? Imagine that in early 2017, rumors spread that KHC eyed Mondelez for a potential acquisition… When riches don’t know what to do with their time…

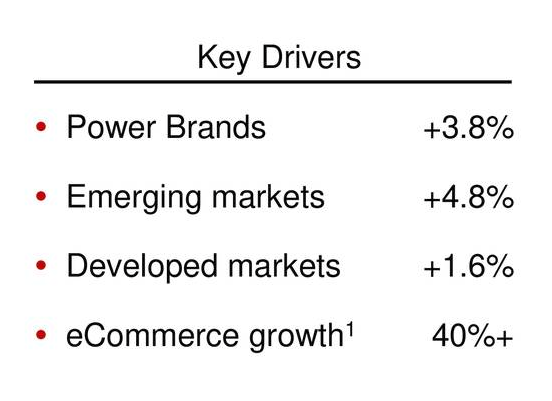

Over the past few years, MDLZ continued to sell their smaller brand in order to improve its focus around its Power Brands. During their latest quarter, management posted some solid numbers showing their strategy worked:

How MDLZ fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income-seeking investors’ rules: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple: when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comse with dividend growth and this is what I am seeking most.

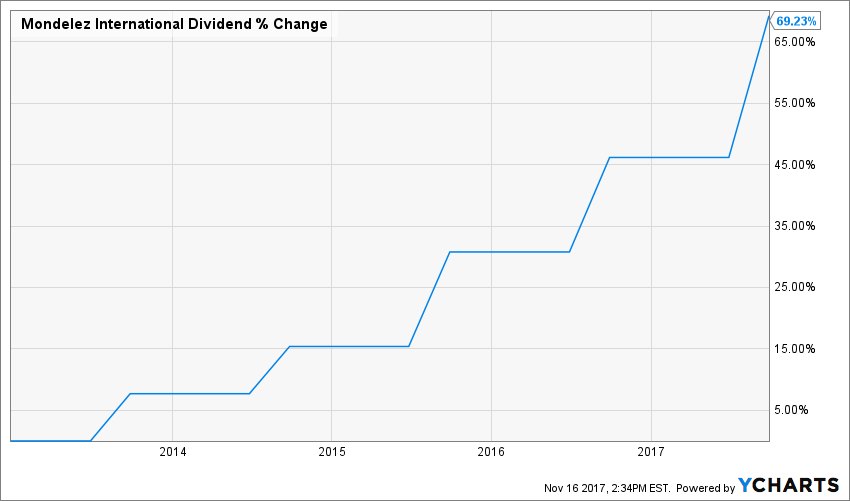

Source: data from Ycharts.

As you can see, when there is a major spin-off, it is difficult to analyze what is left of the “new company”. The dividend kept increasing after the spin-off and so did the price. MDLZ currently rewards shareholders with a 2% yield.

MDLZ meets my 1st investing principles.

Principle #2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

Over the past 5 years, MDLZ has increased its dividend payment. This makes it half-way to becoming a Dividend Achiever. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Mondelez hasn’t just increased its dividend, it offered a double-digit dividend growth (11.1%) over this period.

MDLZ meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

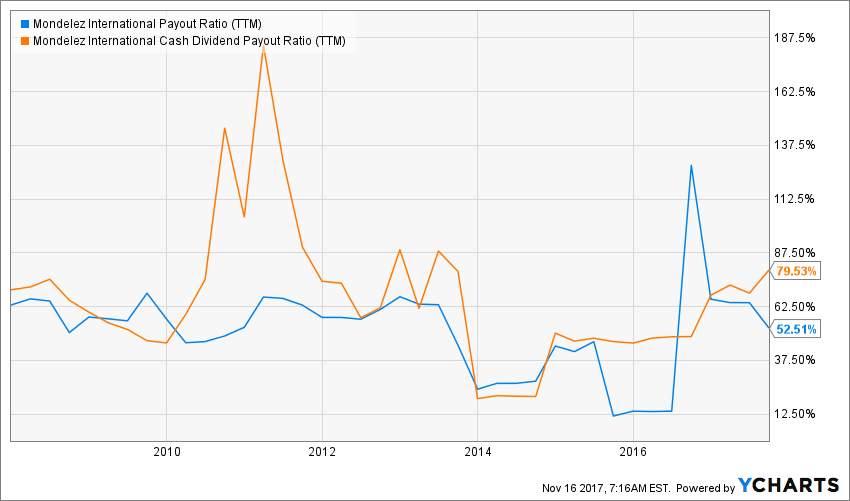

Source: data from Ycharts.

While shareholders have received a substantial raise in paycheck, the company’s dividend payout ratios are still well under control. I don’t expect a double-digit dividend growth rate for several years again, but a high single digit seems sustainable.

MDLZ meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

I like MDLZ’s focus on strong brand while ignoring underperforming ones. I think that a company should always bet on its strengths to become the best in its field. This is exactly what MDLZ is doing. The company currently manages eight $1+ billion brands.

Source: Mondelez website

On top of their Power Brands, MDLZ continues to show positive results across emerging markets and with their eCommerce strategy.

There is definitely a growing interest for the snack industry across the world. The middle class is growing in many emerging markets, leading to additional buying powers and the desire for treats like chocolate and cookies.

MDLZ still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

I must admit that the current 29 PE ratio is not something that makes me cheer. The 12 month forward PE makes more sense at 19.68. Still, we are probably not talking about a deal here.

Digging deeper into this stock valuation, I will use a double-stage dividend discount model. As a dividend growth investor, I’d rather see companies like big money-making machines and assess their value as such.

I’ve used a strong 8% dividend growth rate for the first 10 years. After all, management shows a clear commitment toward rewarding shareholders. Since the company can afford it, the generous increase makes sense.

Here are the details of my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $0.88 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.50% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $85.54 | $51.07 | $36.31 | |

| 10% Premium | $78.41 | $46.81 | $33.28 | |

| Intrinsic Value | $71.28 | $42.56 | $30.25 | |

| 10% Discount | $64.15 | $38.30 | $27.23 | |

| 20% Discount | $57.02 | $34.04 | $24.20 | |

Source: How to use the Dividend Discount Model

According to the DDM, MDLZ trades at a fair market value. Since the market has desperately been seeking for income over the past decade, I appreciate there is no deal for a company generating recurring revenues.

MDLZ meet my 5th investing principle

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by whether or not the company confirms my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

An investment in Mondelez is an investment in a leader in the food industry. What I like about MDLZ is its focus on its power brands. Those brands enjoy stronger pricing power leading to better margins. Mondelez also benefits from a steady growth from emerging markets and its online strategy. As the food industry is consolidating, MDLZ could also become an interesting acquisition for a larger company such as KHC or Unilever (UL).

Potential downsides

The price of commodities such as cocoa and sugar can fluctuate and give MDLZ headaches from time to time. As I previously mentioned, the snack business shows growth opportunities other players haven’t missed. Hershey (HSY), for example, is eyeing the snack business to diversify its operation away from the chocolate industry. This will incur additional pressure on margins.

MDLZ shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

I see Mondelez as a healthy business with interesting growth vectors. However, keep in mind this is a company evolving in a mature market and don’t expect its business to surge from nowhere. MDLZ will be a “hold steady” stock in your portfolio rewarding you with an increasing dividend.

MDLZ is a core holding.

Final Thoughts on MDLZ – Buy, Hold or Sell?

Overall, I like MDLZ business model and growth perspective. I think it’s a good holding for any investors who wish to patiently wait and watch its paycheck growing year after year. As it is currently priced at a fair value, there are better opportunities in the stock market at the moment. I have done a Stock Card on Hershey (HSY) showing it is probably a better deal.

Disclaimer: I do not hold MDLZ in my DividendStocksRock portfolios.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]