Spring is the season for annual reports, and many executives use the occasion to spin a few tales about business in the year past. Though ostensibly these are letters from management to the boss—that is, the owners—far too many seem to take their storytelling lessons from the habits of evasive, guilty teenagers.On rare occasions one finds an honest, clear assessment of the year's work, and such candor is impossible to miss. For the investor, the spring season is one for assessing the pen of management, in order to discern trustworthy and honest stewards of capital.

Of course, candor from management has almost become an endangered species in recent years. Rittenhouse Rankings Inc. has followed this trend with its annual CEO Candor Scores, and in 2007, found that in shareholder letters "confusing and misleading statements or "dangerous fog," increased 66 percent… up from 39 percent five years ago." Instead of providing an impartial and clear analysis of successes and failures, more and more executives speak their Orwellian language, using "words to describe 'the truth we want to exist,' rather than facts." And the point here is not merely pedantic, for Rittenhouse Rankings argue that "high candor scores and rankings reveal high quality leadership, cohesive corporate cultures, more reliable accounting and superior financial performance."

One CEO known for his candor is Wells Fargo's John Stumpf. In his most recent letter to shareholders, Stumpf makes good on his reputation. Though Wells Fargo acquired Wachovia in one of the largest banking acquisitions in the last year, Stumpf does not trumpet their size, for "where [Wells ranks] in asset size alone is meaningless to us… In fact, to our customers, bigness can be a barrier. I've yet to hear of a customer walking into one of our banks and saying, "I want to bank here because you're so … big!"

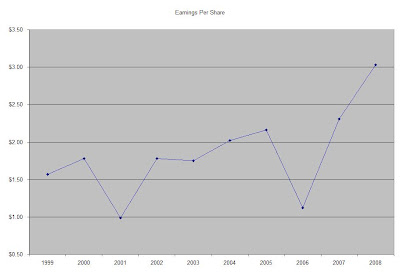

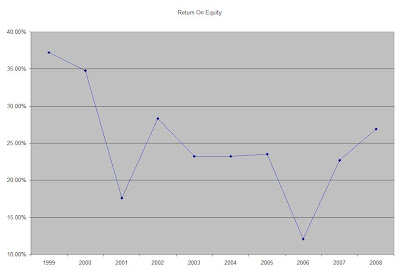

For Stumpf, Wells' annual success should be determined by two metrics—revenue v. expenses, and return on equity. Regarding the first, Wells' revenue grew six percent in 2008, while expenses declined one percent—"the best such revenue/expense ratio among our large peers, and the one we consider the best long-term measure of a company's efficiency." And on the second, Wells' return on equity was 4.79 cents for every dollar of shareholder equity, best among their peers for the year. By the numbers, Wells did more with less than the year before, and it had better returns on shareholder capital than peers. Even in a difficult macroeconomic environment, someone had to be the best. For the large American banks, 2008 was the year of Wells.

As an investor, Stumpf's candor is refreshing, but his focus arguably more important. Rather than telling a lengthy and jargon-laden tale of Wells' growth or enigmatic synergies, Stumpf reveals his concentration on managing his owners' capital productively, and optimizing aspects of Wells' business that he can control. Increasing the loan portfolio may not be a productive use of capital: only if it can be done at adequate margins, and without excessive expense. Rather than spinning a grand story of how our economy went wrong, Stumpf keeps his eye on his business and intelligent opportunities for growth in the year ahead. Though these two tasks need not be exclusive, experience shows that too many bankers love to indulge in forecasting and professoring.

In our assessment of economic moats, managerial ability, more than almost any other factor, directly correlates with the width of a business' moat. Like Andrew Grove, the best managers are capable of rebuilding a protective moat with a new product, even as past competitive advantages deteriorate. Like Warren Buffett, the best managers are capable of redirecting the life blood for building moats—capital—to the best castles with the ablest builders. Like John Stumpf, the best managers are capable of concentrating their gaze on matters they can control, and each day use capital a little better than the day before.

Disclosure: I, own persons whose accounts I manage, own shares of Berkshire Hathaway at the time of this writing.

This article was written by Wide Moat Investing. You may email questions or comments to me at widemoatinvesting@gmail.com.

Continue Reading »